- Home

- Publications

- GIGA Focus

- Digital Africa: How Big Tech and African Startups Are Reshaping the Continent

GIGA Focus Africa

Digital Africa: How Big Tech and African Startups Are Reshaping the Continent

Number 6 | 2022 | ISSN: 1862-3603

Over the past two decades, Africa has become increasingly connected as more and more Africans gained access to the internet and mobile phones. Building on this enhanced connectivity, a new wave of African startups has emerged, tackling some of the continent’s biggest challenges with “homemade” digital technologies. There are growing signs that these new technologies could provide a leapfrogging opportunity for Africa.

Africa has seen massive improvements in internet access and mobile phone adoption, due to investments in the continent’s digital infrastructure, particularly mobile broadband networks. At the same time, there are significant connectivity gaps between Africa and the rest of the world as well as between and within African countries. These may widen as Africa’s digital infrastructure faces capacity pressures from a rapidly expanding internet user base.

Tech giants, primarily from the United States, have recognised a business opportunity in Africa’s existing connectivity gaps and have begun investing heavily in subsea data cables, data centres, and technology hubs. It is critical that these investments bridge Africa’s connectivity gaps – a growing body of evidence shows the wide-ranging positive socio-economic impacts of improved internet and mobile phone access.

Africa’s enhanced connectivity has led to the emergence of a new wave of growth-oriented technology startups, building innovative and “homemade” digital technologies for widespread use. Digital platforms in particular are increasingly disrupting Africa’s major, mostly informal service, retail, and agricultural sectors.

Anecdotal reports suggest that digital technologies from African startups can be transformative for individuals, businesses, and farms, but there is very little systematic empirical evidence on their local impacts. Such evidence is urgently needed to harness their full potential for inclusive economic development in Africa.

Policy Implications

As Africa’s digitalisation accelerates, African governments must develop policies that simultaneously harness the benefits of new technologies and ensure that lagging countries and segments of society do not fall further behind. Policies should incentivise private investment in Africa’s digital infrastructure and encourage entrepreneurship and innovation, while preventing unregulated new technologies from harming consumers. In addition, digital skills need to be strengthened to prepare African countries for the coming digital century.

Digital-Led Development in Africa

In recent years, several African economies have witnessed a digital economy boom with the rapid expansion of sectors that make extensive use of digital technologies. Increasing investments in Africa’s digital infrastructure, particularly mobile broadband networks, and in Africa’s startup ecosystem have given rise to a new generation of IT-savvy entrepreneurs building “homemade” digital technologies for widespread use. For the first time in history, certain digital technologies from Africa spread across the continent and in some cases around the world. The most prominent example of this has been the introduction of mobile money in Kenya, which has subsequently expanded to almost every single African country as well as dozens of low and middle-income countries (LMIC) outside of Africa. The far-reaching socio-economic impacts of mobile money clearly show that new digital technologies in Africa can have an impact far beyond the information and communications technology (ICT) sector. A recent report by GSMA (2021), the biggest industry organisation of mobile network operators, estimates that mobile technologies and services generated 8 per cent of GDP in sub-Saharan Africa in 2021, with indirect productivity benefits in non-ICT sectors accounting for 5 per cent. While this is probably only a rough approximation of the impact of digital technologies in Africa, it is clear that their increasing adoption is fundamentally changing the way Africans interact and how businesses operate across all sectors.

Many of the technological developments are taking place in an economic environment that is characterised by agriculture and services (including retail), which in 2019 accounted respectively for 53 and 36 per cent of total employment in sub-Saharan Africa (SSA) (World Bank 2022). Importantly, in Africa these sectors mostly consist of small-scale activities such as smallholder farming, transportation, and street-trading activities. In fact, according to estimates by the ILO (2019), 80 per cent of total SSA employment occurs in enterprises with fewer than ten employees, and 87 per cent of employees work in informal businesses – that is, ones not registered with relevant national authorities such as the tax office. Compared to agriculture and services, the share of manufacturing employment in SSA is minor at 11 per cent as of 2019, and future rises are doubtful considering the emergence of artificial intelligence, robotics, automation, and 3D printing in many industries.

The prevalence of small-scale and mostly informal agriculture and services combined with the immature state of and sober prospects for manufacturing in Africa poses a major challenge for many African countries. Economic development has historically been associated with industrialisation since today’s developed economies have virtually all passed through an industrial phase that marked a critical turning point on their development path. The rationale for manufacturing as an engine of development is often attributed to the modularity and standardisation of manufactured goods. Such products have great scope for economies of scale and encourage innovation through codified scientific and technical knowledge, leading to increases in productivity and economic growth. However, today’s developed economies are characterised by standardised, mass-produced services that have become a key source of productivity growth, and thereby overall growth, over the past decades. If digital technologies can facilitate the formalisation, modularisation, and standardisation of Africa’s predominantly small-scale and informal service and agricultural activities, this could bring about the much-needed scale and innovation to enable massive increases in productivity and growth. The deployment of digital technologies in Africa’s major agriculture and service sectors could therefore present a leapfrog opportunity for the continent.

However, for digital technologies to be deployed on a large scale, widespread connectivity across Africa is a prerequisite. While increasing private investment in Africa’s digital infrastructure has massively improved connectivity on the continent, this has not happened at the same pace and scale everywhere.

Africa Is Increasingly Connected, but Digital Divides Exist

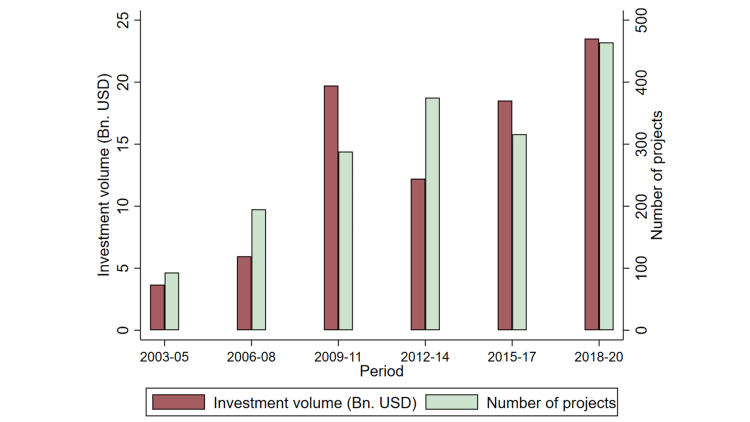

Africa’s ICT sector has witnessed substantial growth over the past two decades, and large multinational corporations have played a key role. Between 2003 and 2020, the number of newly established ICT projects and investment volumes by multinationals in Africa increased approximately fivefold from 93 projects totalling USD 3.7 billion in 2003–2005 to 464 projects and USD 23.5 billion in 2018–2020 (Figure 1). Much of this increase can be attributed to investments in Africa’s digital infrastructure by major telecom companies (telcos) operating in Africa – notably MTN, Orange, Vodacom/Vodafone, and Airtel – who have rolled out their broadband networks across the continent. These investments, particularly in mobile broadband, have led to significant improvements in internet access and mobile phone adoption in Africa over the last two decades. As of 2020, a total of 30 per cent of sub-Saharan Africans used the internet, compared to only 6 per cent in 2010 and 1 per cent in 2000 (World Bank 2022). Over the same period, the number of mobile cellular subscriptions per 100 people increased from 2 in 2000 to 45 by 2010, and to 83 by 2020. Despite these increases, Africa still lags far behind the global average of 85 per cent internet use and 106 mobile phone subscriptions per 100 people.

Figure 1. Greenfield ICT Investment in Africa, 2003–2020

Source: Author’s own construction from data from fDi Markets and Orbis Crossborder Investment.

Note: Only projects in ISIC Rev. 4 ICT sectors are considered.

At the same time, there are significant digital divides between and within African countries, reflected in large differences in internet usage and mobile phone adoption across the continent. For example, internet usage is as high as 58 per cent in Ghana but only 14 per cent in the Democratic Republic of the Congo (DRC), and the number of mobile phone subscriptions (per 100 people) for the same two countries is 130 and 46, respectively. Much of this difference in connectivity comes down to the geographic location of African countries (as subsea internet cable landings and data centres naturally favour countries on the coast) combined with a lack of terrestrial cables connecting landlocked countries to subsea cable networks. The difficulty of extending internet cables inland to offer “last-mile” connectivity to households and businesses has also led to digital divides within countries, as metropolitan areas often have much better access to the internet than secondary cities and rural areas do.

In addition to patchy internet coverage, high costs of accessing the internet still prevent many Africans from joining the digital economy. While 81 per cent of sub-Saharan Africans live within the footprint of a mobile broadband network (GSMA 2021), only 30 per cent use the internet. One major factor contributing to the internet usage gap are high prices of mobile data in Africa compared to Africans’ average income. Across Africa, the average cost for 1 gigabyte (GB) of data is around 7.2 per cent of the average monthly salary, compared to 1.5 and 2.7 per cent in Asia and the Americas, respectively. Again, however, there is significant heterogeneity in the costs of 1GB of data between African countries, making up around 2 per cent of the average monthly salary in Ghana and 30 per cent in the DRC (ITU 2020). To complicate matters further, Africa’s rapid population growth and increasing urbanisation, and the associated growing internet user base, has already put further stress on the existing digital infrastructure. Without major additional investments in its digital infrastructure, connectivity gaps between Africa and the rest of the world and across African countries may continue to grow.

Big Tech’s Increasing Involvement in Africa

In the last few years, some of the world’s tech giants have identified Africa’s existing connectivity gaps and its need for additional investments as a huge business opportunity. Two prominent examples are Google’s and Meta’s respective investments in the Equiano and 2Africa subsea cables, aimed at cutting the costs of access to their services and content in a largely untapped African market. Google’s Equiano subsea internet cable, named after the Nigerian-born writer and abolitionist Olaudah Equiano, will run from Portugal to South Africa along Africa’s western coast and is set to go live by the end of 2022. Google, Africa Practice, and Genesis Analytics (2022) estimate that the cable will increase internet speed by a factor of anywhere from three to five times, cut internet prices by around a fifth, and increase internet penetration by up to 9 per cent in the countries where the cable lands. The 2Africa subsea cable, funded by the 2Africa consortium, which besides Meta includes some of Africa’s largest telcos, is expected to be the longest subsea cable system ever deployed, connecting Europe, the Middle East, and Africa. Meta (2021) projects that once it is operational in 2024 the cable will provide nearly three times the total network capacity of all the subsea cables serving Africa today.

While these investments have the potential to massively improve connectivity across Africa, governments need to carefully monitor whether landlocked regions with hitherto poor connectivity will benefit from them as well. The challenge of providing remote rural regions in Africa with cost-effective “last-mile” connectivity is illustrated by Google’s failed “Project Loon,” which unsuccessfully attempted to do this using high-altitude balloons in the stratosphere. Despite such failures, inclusive connectivity and narrowing connectivity gaps should be a top priority for African governments. This is because a growing body of evidence highlights the wide-ranging positive socio-economic impacts of improved internet and mobile phone access – for example, through raising employment and average incomes (Hjort and Poulsen 2019) as well as improving agricultural productivity and rural livelihoods (Deichmann, Aparajita, and Deepak 2016).

In addition to major investments in subsea cables, primarily US-based enterprise software companies such as IBM, Oracle, and Hewlett-Packard are increasingly serving African markets with a wide range of software solutions. Combined with the mass adoption of mobile phones, this has led to a large increase in the demand for local data centres, which are driving Africa’s burgeoning cloud-computing market. At the same time, several big tech companies including Google, Facebook, Microsoft, and Amazon have recently opened technology and startup hubs for ICT investments in key African markets: South Africa, Nigeria, Egypt, and Kenya.

The rapid expansion of big tech activity in Africa shows that the continent’s digital prospects offer great business opportunities, and that it will be critical to act quickly to take full advantage of them. Foreign tech firms are not the only ones looking to shape Africa’s digital future, however, as digital innovation on the continent is increasingly being driven by young African tech companies.

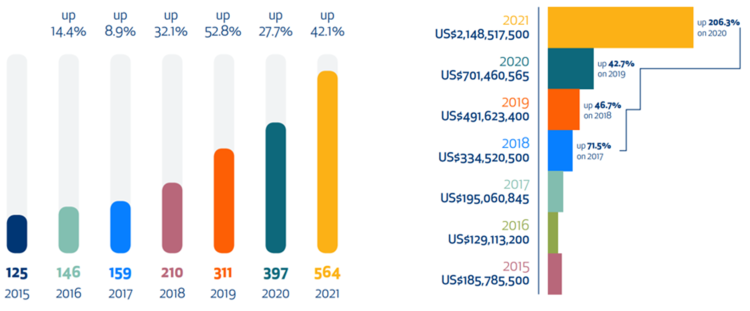

The Emergence of African Startups and “Homemade” Digital Technologies

As more and more Africans have gained access to the internet and mobile phones, a new wave of African startups has emerged, using information and communications technology to offer scalable, “homemade” innovative digital products and services. Often, these new digital solutions are platforms that bring together different market actors to facilitate the distribution or exchange of products, services, and information. Because this new wave of African startups is growth-oriented, unlike the small and mostly informal businesses typical of Africa, they have significant investment needs even in the early stages. Local and international investors – primarily venture capital (VC) firms, but also big tech and development finance institutions – have increasingly recognised the potential of African startups and massively increased their early-stage investment in them in exchange for an ownership stake. The number of newly founded startups and the amount of VC funding raised by startups grew, respectively, from 125 and USD 186 million in 2015 to 564 and USD 2.1 billion in 2021 (Figure 2). The ecosystem’s growth accelerated even more after the outbreak of the COVID-19 pandemic, as it saw by far the largest annual increase in funding between 2020 and 2021, at about 206 per cent.

Figure 2. Number of African Startups (left) and Amount of Venture Capital Raised by Startups (right), 2015–2021

Source: Illustrations from Disrupt Africa (2021).

While the African startup ecosystem is still nascent and small compared to more established ecosystems like that in the US, it is one of the fastest-growing startup ecosystems in the world, and tech startups are among the fastest-growing companies in Africa (Financial Times 2022). At the time of writing, seven African tech startups have achieved “unicorn” status, meaning a valuation of more than USD 1 billion. Africa’s first tech unicorn was Jumia, a pan-African e-commerce startup, often touted as the “Amazon of Africa,” which went public on the New York Stock Exchange in April 2019; just this year, Nigerian fintech Flutterwave was valued at USD 3 billion, making it Africa’s most valuable startup. At the same time, African startups are increasingly becoming takeover targets of multinational corporations. The first two major takeovers occurred in 2020, when the American financial services company Stripe acquired Nigerian fintech Paystack for USD 200 million and when the British international payments company WorldRemit acquired SendWave, another Africa-focused, cross-border payments company, for USD 500 million.

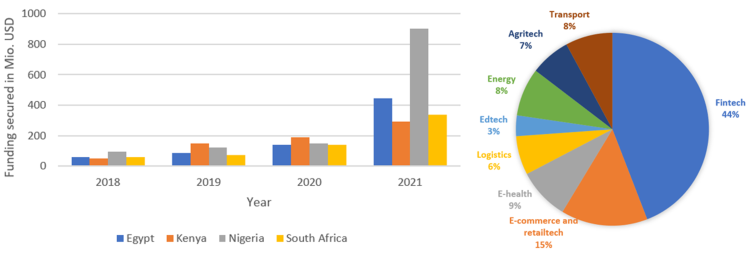

Figure 3. Venture Capital Raised by Startups in the Four Major African Countries (left) and by Sector (right), 2018–2021

Source: Author’s own construction from data from Disrupt Africa (2021).

Note: Only sectors that secured at least USD 100 million in total between 2018 and 2021 are considered.

Paralleling patchy internet coverage and big tech activity, investment in startups has been unevenly distributed across African countries. Most of the funding has flowed into the four major markets of Nigeria, South Africa, Egypt, and Kenya (left panel Figure 3) – in particular, into startups based in the urban centres of Lagos, Cape Town, Johannesburg, Cairo, and Nairobi, which are also Africa’s most developed startup ecosystems. Similarly, investment has been uneven across sectors, with fintech startups raising more than USD 1.5 billion, or 44 per cent of the total funding, between 2018 and 2021 (right panel Figure 3). Behind fintech, e-commerce and retailtech have been the most popular sectors for investment in African tech, accounting for 15 per cent of total investment during the same period. The other major sectors of the ecosystem have all received relatively similar amounts, ranging from 7 to 9 per cent of total investment, with the exception of edtech, which was lower at around 3 per cent. By contrast, no significant investments were made in startups in the manufacturing sector.

“Homemade” Digital Technologies Are Transforming Africa’s Major Sectors

Over the past decade, technology-enabled financial services have spread across the African continent like no other technology or service. The proliferation of fintech has its origin in the enormous potential for improvement inherent in Africa’s undeveloped formal financial system. In 2011, when the African fintech sector was still in its infancy, only around 23 per cent of African individuals had a bank account at a financial institution or with a mobile money service provider (World Bank 2022), precluding the vast majority of Africans from participating in the formal financial system. However, with the expansion of mobile money services across SSA over the past 10 years, this has changed dramatically. Account ownership increased to 34 per cent by 2014 and 55 percent by 2021 as the share of mobile money account holders increased from 10 per cent in 2014 to 33 per cent by 2021 (Wold Bank 2021). At 33 per cent, the share of mobile money account holders in SSA is more than three times the global average of 10 per cent, and in 11 SSA economies, the share of mobile account holders is even higher than the share of holders of an account at a bank or other financial institution.

The spread of mobile money across Africa originated with M-Pesa, Africa’s first and best-known fintech success story, which has grown over the past decade to become Africa’s largest mobile money financial platform. Launched in 2007 by Safaricom, Kenya’s largest telco, the platform allows individuals to make cashless payments through accounts on their mobile phones and deposit money via agents found ubiquitously in urban areas. Since its founding in Kenya, M-Pesa has expanded to six other African countries, with more than 50 million users across Africa, and many of the other major telcos operating in Africa have developed their own mobile money networks for their local markets.

Early evidence by Suri and Jack (2016) suggests that M-Pesa’s impact in Kenya, where the platform has more than 30 million active users, has been enormous, lifting approximately 2 per cent of Kenyan households out of poverty. According to the authors, the platform achieved this by formalising the financial arrangements of previously unbanked household and integrating them into the formal financial system. Although Suri and Jack’s (2016) findings on M-Pesa’s impact in Kenya have been challenged more recently due to important omissions and errors in their analysis, there is growing evidence of the positive socio-economic impacts of mobile money in African countries where it is present (Nan, Zhu, and Markus 2020).

The rise of M-Pesa and mobile money was, however, only the starting point for Africa’s fintech boom, as an influx of funding since around 2015 has propelled several fintech startups across the continent. In particular, a recent wave of startups focused on digital payment processing, predominantly from Nigeria and including the aforementioned Paystack and Flutterwave, have become major players in Africa’s financial services system. Nonetheless, digital transactions still make up only a fraction of all transactions in Africa, and many African individuals and businesses, particularly small and medium-sized enterprises (SME), are still excluded from more advanced financial services such as credit and insurance. Therefore, there is still plenty of room left for fintech companies to deliver broad social and economic benefits by targeting these still underserved individuals and businesses.

Startups in Africa’s second-largest tech sector, e-commerce/retailtech, have not yet achieved the same level of disruption as fintech startups, but some have raised large amounts of funding recently. Unlike in other regions, e-commerce/retailtech startups in Africa target informal retailers rather than selling directly to consumers. For example, between 2017 and 2020 the Kenyan startup Wasoko became Africa’s fastest-growing company in terms of revenue (Financial Times 2022) by addressing key challenges faced by informal retailers. First launched in 2013, Wasoko allows retailers to order goods from local and multinational suppliers via SMS or their mobile platforms for same-day delivery to their stores and shops. Wasoko has built up its own distribution chain from warehousing to logistics, for which the company has secured more than USD 140 million in funding to serve retailers, offering them short-term financing through “buy now pay later” services. While Wasoko has expanded into the neighbouring East African markets of Tanzania, Rwanda, and Uganda, the biggest West African markets, Nigeria and Ghana, have been dominated by the Nigerian startup TradeDepot, which offers similar B2B marketplace and logistics services to informal retailers in the regions. At the same time, other startups such as Nigeria’s Kippa and Egypt’s Sabi have identified a business opportunity in the often suboptimal management practices of informal retailers, providing them with app-based bookkeeping as well as customer, store, and sales management tools. While the rapid growth of B2B platforms for informal retailers indicates that improved access to inputs from suppliers can have an immediate impact on SMEs, evidence on management trainings in SMEs suggests that it can be very hard to get SMEs to adopt new business practices, even if they are beneficial for them (McKenzie 2021).

Alongside fintech and e-commerce/retailtech, agritech is arguably the African tech sector with the greatest potential for inclusive growth. Agriculture employs the majority of Africans, but it is riddled with inefficiencies that make the continent a net importer of food despite having around a quarter of the world’s arable land. Since African agriculture is dominated by smallholder farmers, agritech startups primarily focus on their biggest pain points, again often using scalable digital platforms. The most prominent example is Twiga Food’s (Twiga) online B2B marketplace for agricultural produce, which has made the agritech startup one of the largest agricultural wholesalers in Kenya. Since its founding in 2014, Twiga has raised more than USD 100 million to build its own distribution chain, including from the International Finance Corporation (IFC), and now connects over 100,000 farmers and vendors through its platform. According to Twiga, farmers benefit from higher prices, guaranteed market access, and reduced loss, while vendors benefit from fresher and better-quality food. In addition to marketplace platforms, other startups, such as WeFarm, SunCulture, and Releaf, have focused on enhancing access to extension services through peer-to-peer knowledge-sharing platforms, solar-powered water-pumping systems, and African crop-processing technology. While these new digital technologies show promise, their scalability and wider adoption have yet to be assessed, which has proven difficult for many innovations in agriculture (Deichmann, Aparajita, and Deepak 2016).

The selected – albeit far from comprehensive – examples illustrate that digital technologies, and in particular digital platforms, can have transformative impacts on the individuals, businesses, and farms that adopt them. Overall, however, with the notable exception of mobile money, there is almost no rigorous empirical evidence on the local impacts of these “homemade” digital technologies. At the same time, very little is known about the contribution of African startups to development in Africa, though we know from other places such as the United States, for example, that a few high-growth startups – so-called “gazelles” – contribute disproportionately to job creation, output, productivity growth, and structural transformation (Haltiwanger et al. 2017). Hence, research that focuses on African startups and the local impact of their digital technologies is urgently needed to harness the full potential of new technologies for inclusive economic development in Africa.

Building an Innovation-Friendly and Inclusive Digital Africa

Digitalisation is a recent phenomenon in Africa, so it is not surprising that many digital advances are concentrated in a few urban centres of major African markets. As Africa’s digitalisation accelerates, however, it will become increasingly important for African governments and their partners to develop policies that simultaneously capitalise on the tremendous benefits of emerging technologies, while ensuring that less digitalised African countries and parts of society do not fall further behind in terms of their digital development and broader socio-economic development.

In general, the increasing activity of big tech in Africa represents an immense opportunity for African economies, which can benefit from their technology, know-how, and financial resources, among other things. Additionally, big tech companies can foster local entrepreneurship when they act as anchor customers, talent providers, and investors in local startups. At the same time, however, it may prove impossible to provide some of Africa’s most remote regions with “last-mile” terrestrial connectivity in a manner considered cost-effective for the private sector. Political initiatives such as the Smart Africa Alliance, a partnership among 32 African governments and multinational organisations including the World Bank and the African Development Bank, can be an important element here as they promote widespread, affordable access to broadband. In addition, African governments must safeguard against a scenario in which tech giants become monopolistic gatekeepers, crushing their smaller competitors. Recent investigations against Apple, Google, Uber Eats, Airbnb, and Booking.com in South Africa for anti-competitive behaviour are a striking example of the risks associated with big tech’s involvement in Africa. Therefore, the challenge for African governments will be to harness the potential of big tech while regulating its pitfalls.

To promote local entrepreneurship and technological innovation, however, antitrust regulation will hardly suffice. In many African countries, entrepreneurs still find it difficult to start and scale their businesses due to a burdensome regulatory environment. To improve the status quo, several African countries have either passed national startup laws (Tunisia, Senegal) or approved them in their respective parliaments (Kenya, Ethiopia, Nigeria). Startup legislation aims to make starting, operating, and scaling businesses easier by clarifying investment standards, subsidising entrepreneurs’ salaries, and providing tax breaks, government loans, and credit guarantees for young companies. Alongside such tangible benefits, this legislation aims to bridge the engagement gap between startups and regulators, ensuring that regulation is sensible and does not stand in the way of innovation. For example, prior to the passage of the Nigerian Startup Bill, the Central Bank of Nigeria had banned all types of cryptocurrency transactions in the country. Similarly, Lagos State had banned bike-hailing services in Nigeria’s most populous city. Such bans make it practically impossible for startups in these sectors to compete with incumbents and thus prevent technological innovation. On the other hand, leaving new technologies completely unregulated can hurt consumers, as in Kenya, for example, when several fintech startups entered the market with high-interest loans, trapping people in debt. Startup bills can be an important tool for governments to strike a balance between draconian measures such as outright bans and the wholly unregulated use of new technologies.

International and multinational partners of African governments can play a crucial role in supporting entrepreneurship and innovation in Africa, particularly by empowering groups such as homegrown (i.e. African-born and African-educated) entrepreneurs, particularly women, who are severely underrepresented in Africa’s tech sector. One way to do this is through providing financial and technical support to startup incubators and accelerators that specifically target these underrepresented groups. When it comes to investing in local startups, partners, particularly development banks, can play an important role by contributing with their financial resources to investment funds managed by experienced venture investors. Good examples of this include KfW’s EUR 45 million and IFC’s USD 26 million investments in the Partech Africa Fund II, which targets African tech startups. Investments from partners can be particularly valuable when they target startups in sectors with potentially outsized positive socio-economic impacts – such as e-health and edtech, which have received comparatively little attention from big tech and VCs because these sectors are not easy to monetise.

Last but not least, digital and programming skills are indispensable to Africa’s ability to create “homemade” innovation and inclusive digitalisation. However, a major challenge faced by foreign multinational companies and by local businesses and startups is the lack of professional software developers in Africa. Despite recent advances, Africa has only slightly more developers than California – nearly 700,000 compared to 630,000; additionally, half of the African developers come from just a handful of countries (Google and IFC 2020). The lack of tech talent is also one of the main reasons tech giants such as Google and startups such as Andela have started training African software developers on a large scale. While these private efforts are commendable, they are unlikely to transcend the shortcomings of the African public tertiary education system, which is often accused of being outdated and overly theoretical with insufficient contact with market needs. Close cooperation between the private sector and African universities is imperative here in order to design state-of-the-art and practice-oriented university programmes in a rapidly changing digital world. Expanding the pool of tech talent in Africa will also require instilling digital skills from an early age. Encouragingly, more and more African governments are recognising this need in their national digitalisation plans. For example, the Kenyan government recently included coding as a subject within the official curriculum for primary and secondary schools, and the Rwandan government will expand its “Smart Classroom” programme across the entire country, equipping primary and secondary schools with an IT infrastructure.

In summary, digitalisation is gaining momentum in Africa as the continent experiences significant improvements in its digital infrastructure and a vibrant startup ecosystem. To harness this momentum across society, African governments and their partners will need to strike the right balance between policies that attract private investment in Africa’s digital infrastructure and promote local entrepreneurship, innovation, competition, and digital skills, while preventing unregulated new technologies from harming consumers. This will be a major challenge for African governments and their partners, but also a great opportunity for the continent to leap forward in the coming digital century.

Acknowledgement

I would like to thank Andrew Crawford for his detailed comments and suggestions. I am also grateful for the funding from the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) under the “Future of Work” measure of the GIGA project “Platforms and online workers in India and Africa: Challenges and opportunities for decent work,” which made significant parts of this article possible.

Footnotes

References

Deichmann, Uwe, Aparajita Goyal, and Deepak Mishra (2016), Will Digital Technologies Transform Agriculture in Developing Countries?, in: Agricultural Economics, 47, S1, 21–33.

Financial Times (2022), FT Ranking: Africa’s Fastest Growing Companies 2022, accessed 11 July 2022.

Google, and IFC (2020), e-Conomy Africa 2020, accessed 20 August 2022.

Google, Africa Practice, and Genesis Analytics (2022), Equiano Subsea Cable: Regional Economic Impact Assessment, accessed 5 August 2022.

GSMA (2021), The Mobile Economy Sub-Saharan Africa 2021, The Mobile Economy Report.

Haltiwanger, John, Ron S. Jarmin, Robert Kulick, and Javier Miranda (2017), High-Growth Young Firms: Contribution to Job, Output, and Productivity Growth, in: Haltiwanger, John et al. (eds), Measuring Entrepreneurial Businesses: Current Knowledge and Challenges, Chicago: University of Chicago Press, 11–62.

Hjort, Jonas, and Jonas Poulsen (2019), The Arrival of Fast Internet and Employment in Africa, in: American Economic Review, 109, 3, 1032–1079.

ILO (2019), Small Matters, accessed 29 October 2022.

ITU (2020), Measuring Digital Development ICT Price Trends, ITU Publications.

McKenzie, David (2021), Small Business Training to Improve Management Practices in Developing Countries: Re-Assessing the Evidence for ‘Training Doesn’t Work’, in: Oxford Review of Economic Policy, 37, 2, 276–301.

Meta (2021), 2Africa Pearls Subsea Cable Connects Africa, Europe, and Asia to Bring Affordable, High-Speed Internet to 3 Billion People, accessed 9 August 2022.

Nan, Wenxiu V., Xiaolin C. Zhu, and M. Lynne Markus (2020), What We Know and Don’t Know About the Socioeconomic Impacts of Mobile Money in Sub‐Saharan Africa: A Systematic Literature Review, in: Electronic Journal of Information Systems in Developing Countries, 22.

Suri, Tavneet, and William Jack (2016), The Long-Run Poverty and Gender Impacts of Mobile Money, in: Science, 354, 6317, 1288–1292.

World Bank (2022), World Development Indicators, accessed 1 August 2022.

World Bank (2021), The Global Findex Database: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19, accessed 4 October 2022.

General Editor GIGA Focus

Editor GIGA Focus Africa

Editorial Department GIGA Focus Africa

Regional Institutes

Research Programmes

How to cite this article

Tafese, Tevin (2022), Digital Africa: How Big Tech and African Startups Are Reshaping the Continent, GIGA Focus Africa, 6, Hamburg: German Institute for Global and Area Studies (GIGA), https://doi.org/10.57671/gfaf-22062

Imprint

The GIGA Focus is an Open Access publication and can be read on the Internet and downloaded free of charge at www.giga-hamburg.de/en/publications/giga-focus. According to the conditions of the Creative-Commons license Attribution-No Derivative Works 3.0, this publication may be freely duplicated, circulated, and made accessible to the public. The particular conditions include the correct indication of the initial publication as GIGA Focus and no changes in or abbreviation of texts.

The German Institute for Global and Area Studies (GIGA) – Leibniz-Institut für Globale und Regionale Studien in Hamburg publishes the Focus series on Africa, Asia, Latin America, the Middle East and global issues. The GIGA Focus is edited and published by the GIGA. The views and opinions expressed are solely those of the authors and do not necessarily reflect those of the institute. Authors alone are responsible for the content of their articles. GIGA and the authors cannot be held liable for any errors and omissions, or for any consequences arising from the use of the information provided.