- Startseite

- Publikationen

- GIGA Focus

- Africa after the Covid-19 Lockdowns: Economic Impacts and Prospects

GIGA Focus Afrika

Afrika nach den COVID-19-Lockdowns: wirtschaftliche Auswirkungen und Perspektiven

Nummer 6 | 2020 | ISSN: 1862-3603

Aufgrund des COVID-19-Lockdowns ging das südafrikanische Bruttoinlandsprodukt zwischen dem ersten und zweiten Quartal 2020 um 51 Prozent zurück. Ein kürzlich veröffentlichter Bericht der Weltbank schätzt, dass durch die Pandemie 26 bis 40 Millionen Menschen in Afrika südlich der Sahara zusätzlich in die Armut rutschen werden. Gleichzeitig zeigen einige afrikanische Volkswirtschaften erste Anzeichen wirtschaftlicher Erholung.

Die meisten afrikanischen Regierungen reagierten auf die Pandemie mit strengen Lockdowns, was schwerwiegende wirtschaftliche Folgen zeitigte. Die wirtschaftlichen Auswirkungen der Pandemie sind vielfältig und fallen sehr unterschiedlich zwischen den einzelnen Ländern, zwischen dem informellen und dem formellen Sektor und den verschiedenen Branchen und gehandelten Produkten aus.

Der starke Rückgang in Südafrika korrespondiert mit ersten Anzeichen einer Erholung sowohl in West- als auch in Ostafrika. Beschäftigte im informellen Sektor haben während der Lockdowns auf dem gesamten Kontinent drastische kurzfristige Einkommensverluste erlitten, da nur sehr wenige durch soziale Sicherungssysteme oder andere Maßnahmen geschützt sind.

Der internationale Handel ist dramatisch eingebrochen, aber es gibt wichtige Unterschiede zwischen Exportprodukten. Die ausländischen Direktinvestitionen dürften 2020 erheblich zurückgehen und zwar selbst in Sektoren, die als Schlüssel für eine Beschleunigung der wirtschaftlichen Entwicklung Afrikas gelten.

Die wirtschaftliche Unterstützung durch afrikanische Regierungen war weitaus moderater als anderenorts, obwohl die internationale Gemeinschaft den afrikanischen Volkswirtschaften zusätzliche Mittel zur Verfügung gestellt hat.

Fazit

Eine rasche Erholung von den Auswirkungen der Pandemie könnte Rückschläge für Afrikas wirtschaftliche Entwicklung und Armutsbekämpfung verhindern. Dies erfordert eine schnelle Reaktion, wobei gezielt nach Ländern, Branchen und betroffenen Arbeitnehmern unterschieden wird. Die „neue Normalität“ sollte den wirtschaftlichen Kosten pandemiebedingter Beschränkungen mehr Gewicht beimessen. Mittelfristig müssen die afrikanischen Regierungen die Widerstandsfähigkeit ihrer Volkswirtschaften und der Bevölkerung gegenüber (wirtschaftlichen) Schocks erhöhen.

Low Infections, Lower Mortality, and Strict Lockdowns: Covid-19 in Africa

The spread of the pandemic and its health impacts have – so it seems – been different in Africa than in other world regions. First, Africa has relatively low absolute infection rates: in mid-September, less than 5 per cent of global confirmed Covid-19 cases were in Africa, while approximately 17 per cent of the world population lives on the continent. Daily infections peaked in July in most countries, and the number of confirmed cases in Africa surpassed the one-million mark in August 2020, with roughly half of those cases concentrated in South Africa. Second, it seems that outside of South Africa, mortality is lower in Africa than elsewhere. This is despite the share of positive tests being comparable to other world regions (Mbow et al. 2020), which means low case numbers cannot be attributed to low testing rates alone.

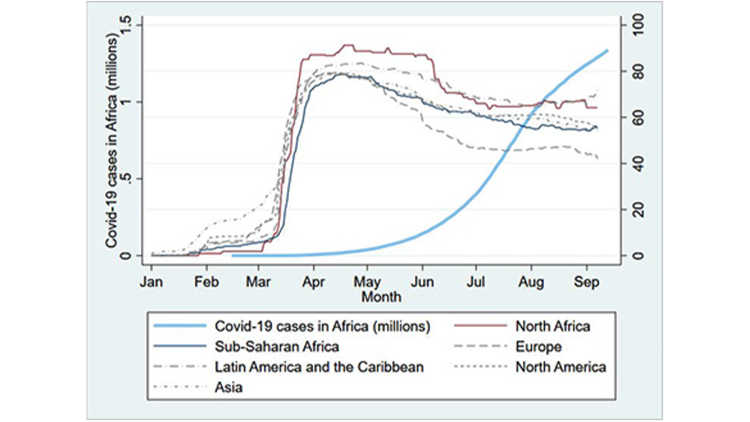

At this stage, it seems likely that early fears that Covid-19 would claim a dramatic number of lives in Africa and overwhelm its weak health systems were overblown (Wills 2020). Yet the paucity of data means that the figures showing a somewhat milder trajectory for Covid-19 in Africa need to be interpreted with great care. On the one hand, it is conceivable that official figures obscure the severity and extent of the pandemic, as deaths may be underreported and testing strategies may differ systematically from those in other regions. On the other hand, mortality may really be lower – not only because Africa’s population is much younger, but also because of a lower incidence of risk factors, such as cardiovascular diseases, obesity, and diabetes. On average, lockdowns in Africa were strict compared to other world regions. They were upheld longer than in Europe, as Figure 1 illustrates. While restrictions on business activities were lifted gradually, mostly between May and July, night-time curfews are still in place in countries such as South Africa, Nigeria, Kenya, and Uganda. Discussions about reopening schools are still underway in Kenya, but Ghana and Côte d’Ivoire are gradually sending students back to school. In June 2020, virtually all of Africa’s 54 countries had suspended international flights, 38 countries had announced the closure of land borders, and 17 countries had closed their maritime borders. Since mid-September, commercial international flights to Kenya, Rwanda, Ghana and Nigeria have resumed, but flights to South Africa have not.

These swift and aggressive containment measures have come at enormous economic cost. While governments around the world have put up considerable funds to protect their citizens from income shortfalls and job losses, support in most African countries has been limited. We provide an overview of these responses and donor support below, before assessing the current knowledge about the economic impacts at the time of writing – the last week of September 2020. We first look at the domestic impacts and then evaluate the limited evidence that is available on the impacts of the pandemic on trade and on foreign direct investment (FDI) flows.

Note that we omit a detailed discussion of the pandemic�’s impact on remittances and the subsequent economic impacts. The impacts may be severe, with early World Bank projections suggesting that Africa’s received remittances could decline by more than 20 per cent (World Bank Group and KNOMAD 2020), hitting remittance-dependent countries, such as Senegal and Zimbabwe, particularly hard. Yet there is little evidence about what has really happened to date. Recent IMF figures suggest that remittances to some countries, including Kenya, have been surprisingly resilient in recent months (Quayyum and Kpodar 2020).

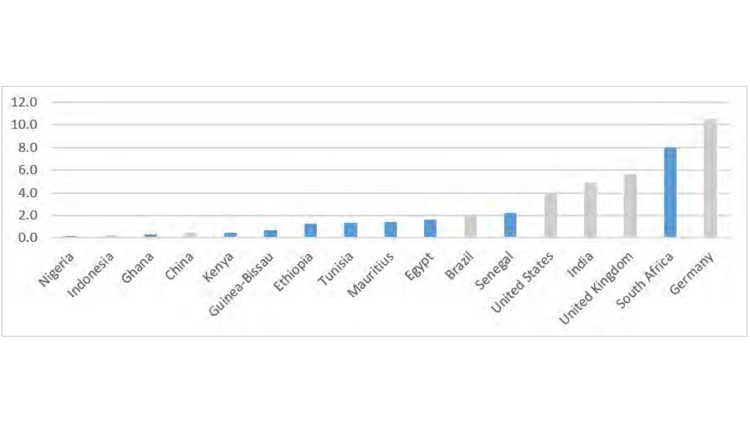

Limited Domestic Support and an Adequate Aid Response

While the lockdowns in African countries were generally strict, many African governments provided much less economic support to their citizens and businesses than their counterparts in other world regions. As Figure 2 shows, the additional, non-health government spending announced is below 2 per cent of GDP for most African countries we have information on, compared to more than 10 per cent of GDP in Germany. Although these figures are not strictly comparable, they provide an indication that the volume of support has been low in most African economies, despite recent progress in establishing social safety nets in sub-Saharan Africa (see Bodewig et al. 2020). Most African countries have at least one social protection programme in place. Nigeria increased coverage of its transfer programme by one million beneficiaries. The Togolese government is currently introducing Novissi, a temporary cash transfer programme to cushion the impact of the Covid-19 shock. Still, the reach of these systems is often limited, compared, for example, to such systems in Latin America (Blofield et al. 2020). A World Bank mapping of social protection responses to the pandemic concludes that only 5 per cent of sub-Saharan Africa’s population is covered by cash transfer or in-kind schemes, compared to a global average of 22 per cent (Gentilini et al. 2020).

Despite the relatively moderate increases in government spending, the restrictions have led, quickly, to payment difficulties for African governments due to forgone tax revenues. There have been important multilateral and bilateral efforts to increase the fiscal space for African governments. The G20 finance ministers agreed in April to suspend debt service payments on all official bilateral debt until the end of the year for the poorest countries. The initiative could free up between 0.1 per cent and 3.1 per cent of GDP for the 30 participating African countries (excluding Nigeria, Kenya, and Ghana). It requires governments to commit to greater debt transparency as well as to using the resources for social, health, or economic spending (World Bank 2020d). In addition to the suspension of repayments for bilateral debt, the IMF has granted USD 214 million in debt relief. Further, the IMF has provided close to USD 19 billion in emergency financing and approximately USD 6 billion in additional regular financing to African governments.

Significant multilateral support has come from the World Bank, which announced in April that up to USD 55 billion would be spent countering Covid-19 in Africa over the course of 15 months. Two-thirds of the World Bank projects will address the health sector, although some also include social protection components. Private sector support has mainly been channelled through the International Finance Corporation (IFC), which is providing loans to banks and large companies as part of its fast track programme. Just over USD 2 billion have been committed so far, and USD 422 million have gone to Africa, spread over seven African banks and two non-financial companies. The African Development Bank (AfDB) has created a Covid-19 response facility worth USD 10 billion. By mid-September, loans and grants worth USD 2.3 billion had been approved.

Comparable figures on bilateral aid responses to the pandemic are hard to come by, but most donor governments have issued announcements on additional foreign-aid spending. It is not always possible to conclude whether the funds are additional or have been made available by restructuring existing foreign-aid budgets, and the amounts announced often include contributions to multilateral institutions. The European Union has announced that EUR 3.25 billion from its Covid-19 response package will go to Africa. The United States, as of late August, had announced Covid-19 response projects targeting African countries, with a strong health focus, worth more than USD 500 million. In the United Kingdom, the twin announcements of a merger of the Department for International Development with the Foreign and Commonwealth Office and a drastic GBP 2.9 billion reduction in the aid budget have increased uncertainty over the Covid-19 response. The German Federal Ministry of Economic Development and Cooperation has announced a EUR 4 billion package to respond to the pandemic, which includes EUR 3 billion in new funding. A regional breakdown is not provided, but Africa is a strong focus. EUR 520 million will be dedicated to social protection and securing jobs in global supply chains, including through the Africa-focused Special Initiative on Training and Job Creation.

It is fair to say that donors have responded to the crisis in a timely and significant manner, though open questions remain, including whether the expansion of debt relief will extend beyond the poorest countries (see Okonjo-Iweala et al. 2020). The above figures on actual disbursements vis-à-vis commitments suggest that another key challenge from April onwards has been implementation – rather than simply a lack of resources. Even in normal times, African governments – especially those dependent on aid – tend to work at the limits of their absorptive capacity. Although it is too early to judge the effectiveness and efficiency of the support measures taken, it is apparent that African governments were ill-prepared for the crisis. They had to resort to measures that were easily implemented but typically meant forgoing tax revenue or other fees. Well-targeted instruments for the poor, in particular social protection schemes, or for particularly affected groups – for example, firms in certain sectors – were hardly available. This is also apparent in the economic impacts seen to date.

Domestic Growth and Welfare Impacts: Huge Country Differences and Informal Sector Vulnerability

In early October, the World Bank estimated that a decline in global GDP per capita growth of 5 per cent – the baseline scenario for 2020 – would increase the number of Africans living below the international poverty line of USD 1.90 (2011 PPP) by 26 million. This would mean that the overall poverty rate in Africa would remain well above 40 per cent. In the case of prolonged lockdowns, possibly combined with a larger global economic downturn, these figures could be much larger. For instance, an 8 per cent decline in global GDP per capita growth could push an additional 40 million people in sub-Saharan Africa into poverty.

Our reading of aggregate economic indicators for April to July and the economic news from various African countries suggests that economic recovery may happen more quickly than some observers have anticipated for some countries, while others face more severe and possibly more contracted crises. South Africa saw a particularly sharp contraction of 51 per cent of GDP from the first to the second quarter, which also implies a contraction of roughly 50 per cent on a year-to-year basis (Stats SA, 2020; World Economic Forum 2020). Other countries that have reported figures for the second quarter of 2020 have also reported contractions but have fared relatively better overall. Nigeria and Ghana have reported output declines of approximately 6 per cent (year-on-year) in the second quarter of 2020, but Ghana’s figures for July suggest a quick recovery with a year-on-year positive growth of 3.8 per cent for June (Bank of Ghana 2020). Similarly, Uganda has reported positive year-on-year growth for June with 0.21 per cent compared to a year-on-year contraction by 7.2 per cent in May (Ugandan Ministry of Finance Planning and Economic Development 2020). Recent economic indicators from Kenya, including data on mobile payments and on international trade (Kenya National Bureau of Statistics 2020; Omondi 2020), also appear to show some signs of economic recovery. This admittedly patchy picture suggests that some countries’ growth may exceed expectations, while other countries, in particular South Africa, may considerably underperform even relative to the worst-case scenarios. South Africa’s sharp economic decline is a consequence not only of strict lockdown policies and a high incidence of Covid-19 infections, but also of initial vulnerability and weak previous economic performance, with record unemployment of 30 per cent even before the pandemic hit. South Africa’s weakness may spill over to neighbours such as Botswana and Namibia. Further, oil-dependent economies are suffering from a dual shock of lockdown policies and much lower oil prices, which may also lead to sharper contractions and prolonged recession.

Differences in the impacts of the crisis can be seen not only between but also within countries, and the cited aggregate economic performance indicators conceal much of this impact heterogeneity. Household welfare and poverty impacts depend very much on the effects of the shock on wages and employment, which in turn depend on which sectors are most heavily hit. As everywhere in the world, tourism, restaurants and bars, and personal services are more affected than agriculture and telecommunication services. Evidence from several African countries shows that the economic activities of the informal sector have been very severely affected by the lockdown measures, with a GIGA study of 340 informal entrepreneurs in Kampala finding that many were closed down temporarily and experienced sharp decreases in profits, often to zero (Hartwig and Lakemann 2020). In Nigeria, the share of household survey respondents who were working dropped from pre-crisis levels of approximately 85 per cent to 43 per cent in April. This share had almost fully recovered in rural areas by July 2020 while remaining 11 percentage points lower in urban areas, suggesting that the urban informal sector had not yet fully recovered (Nigerian National Bureau of Statistics and World Bank 2020). In terms of safety nets and coping mechanisms, households in Nigeria and Uganda have mainly depleted savings and relied on family and friends for assistance. These results demonstrate that those employed in the urban informal sector remained largely unprotected against the impacts of the crisis. Even when countries have social transfer schemes in place, these mainly target the ultra-poor and are thus not designed to reach slightly better off, but still vulnerable households in the urban informal sector. And specific measures targeting informal firms may typically not have been sufficient to protect against the massive income losses (Schwettmann 2020). The key question, which is difficult to answer at the moment, is how fast informal firms will recover to pre-crisis income levels and whether the potential depletion of firm and personal assets will have caused longer-term harm.

While quite a great deal of evidence is available on the severe short-term impacts of the lockdowns on informal workers, much less is known about and little data is available on the impacts on formal jobs. An exception is the Business Tracker Survey of approximately 4,000 Ghanaian firms interviewed in May/June this year (World Bank 2020a). While almost half the firms cut wages, only 4 per cent laid off workers. News reports of relatively large employment losses that are very likely to include formal jobs come from Kenya (Ecofin Agency 2020; Omondi 2020), though the figures have to be interpreted with great care.

Sharp Declines in Trade, But Not in All Products

According to United Nations Economic Commission for Africa (UNECA), African exports in 2020 declined by 5 per cent in February, 16 per cent in March and 32 per cent in April (compared to the same month of the previous year) (UNECA (2020b). Africa’s imports experienced a similar decline in the same months of 1 per cent, 7 per cent, and 25 per cent, respectively. The slump in African trade was thus even larger than the decline in the volume of global merchandise trade, which is estimated to have declined by 3 per cent in the first quarter of 2020 and 18.5 per cent in the second. The World Bank forecasts a decline in exports and imports of 11 per cent and 7 per cent, respectively, for the sub-Saharan region (World Bank 2020c).

Factors underlying the drastic decline in trade include the slowdown in global demand; declining commodity prices, especially for crude oil; supply chain disruptions; and export restrictions. Aggregate figures on African trade, however, conceal the heterogeneous sectoral impacts across the continent. Negative impacts were especially harsh for oil exporters such as Angola and Nigeria, where the value of exports declined by approximately 30 per cent and 50 per cent, respectively, in the months of March and April 2020 (UNECA 2020a). Similarly, exporters of minerals such as Botswana and Namibia experienced substantial declines in export volumes due to lower global demand.

African exports of agricultural products have proven to be more resilient, increasing by more than 6 per cent in the first quarter of 2020, remaining stable in March 2020 and decreasing by approximately 1 per cent in April 2020 (all relative to the same month in 2019, WTO 2020). However, the impacts were heterogeneous across exporters of agricultural products. For example, the four cotton-exporting countries Benin, Burkina Faso, Chad, and Mali experienced large slumps in exports in April (between 33 per cent and 54 per cent). In contrast, exports of other agricultural products such as staple foods, processed fruits, vegetables, and coffee only decreased moderately or even increased slightly in the first quarter of 2020. The April drop in exports was much less pronounced for edible agricultural products than for other products. For a few countries, including Ethiopia, exports in April 2020 were even higher than in the previous year because of increases in selected agricultural products. Encouraging evidence of a quicker recovery than expected comes from Kenya, mainly due to a rebound in earnings from horticulture. While exports in April were 13 per cent lower compared to April 2019, they were 3 per cent above the 2019 value by July 2020 (Kenya National Bureau of Statistics 2020).

African imports also fell sharply as the global pandemic unfolded, with notable differences across sectors and countries. While about half of African countries recorded import growth in the first quarter of 2020 compared to 2019, all but two saw their imports decrease in April, driven by the trade restrictions and a lower fuel import bill (AFREC 2020). Notwithstanding this overall decrease and despite falling prices, imports of agricultural products increased by more than 10 per cent in April in numerous African countries (WTO 2020). And although threats to food security – partly related to Covid-19 – are an issue in (parts of) certain countries (World Bank 2020b), food trade has remained resilient and has secured the food supply in Africa’s import-dependent food markets (at the aggregate level, approximately 85 per cent of Africa’s food comes from outside the continent).

In sum, the particularities of Africa’s integration into the world economy have had diverse impacts on the continent’s trade performance. While the “traditional” oil price slump, which has also accompanied previous economic crises, affects the usual suspects in expected ways, we see effects on agricultural and food exports as well as on imports that are specific to this crisis.

Drastic Short-Term Declines in FDI

Trade and domestic economic performance matter for FDI decisions, which will in turn shape the future integration of Africa into the world economy. The economic downturn and the uncertainty induced by the pandemic may mean that foreign firms disinvest and/or that planned and new investment projects are postponed or cancelled. Estimates by UNCTAD (2020b) suggest that multinational enterprises in Africa are revising their earnings downwards by approximately 11 per cent. Recent surveys of European firms active abroad shed some light on their potential responses to the crisis. Of a small sample of French and German firms active in Ghana, 66 per cent indicated in April that they were planning to postpone or cancel investment as a response to the crisis (AHK Ghana and CCI France Ghana 2020), and almost half of German firms active in Kenya said the same (DIHK and AHK 2020). The majority of European firms surveyed in Ghana said they needed to lay off staff or were attempting to cut costs in an effort to prevent layoffs (AHK Ghana and CCI France Ghana 2020).

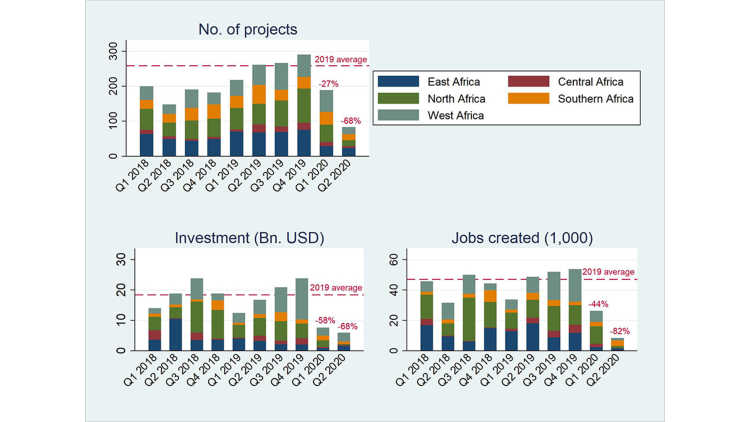

Recent data show a strong reduction in announced greenfield FDI projects in Africa in the first half of 2020. Figure 3 depicts the quarterly number of announced projects, investment volumes, and jobs created for all African regions from the fdi Markets database. The negative effects on greenfield FDI markets were pronounced in the first quarter of 2020 and amplified in the second quarter of 2020. Recent data from the months of July and August 2020 suggests that a quick recovery to pre-crisis levels is unlikely, although the year-on-year decline is less drastic than for the second quarter.

The actual and expected impact of Covid-19 on greenfield FDI in Africa varies between sectors, although no activities are exempt from the strong decline. Greenfield FDI in the service sector, which attracted almost 60 per cent of newly announced greenfield investment volume in 2019, has not been spared negative impacts. Investments in key sectors such as construction, electricity, or transport have declined strongly, by more than 50 per cent of investment volume. The aviation industry and the tourism sector have been gravely affected, with an estimated decline in worldwide tourist arrivals of between 58 and 78 per cent (CCSA 2020) and a decline of approximately 93 per cent in investment amounts in greenfield projects in tourism. As much of Africa’s tourism relies on long-distance travel and tourists from severely affected world areas, its recovery may be slower than in other parts of the world. Other sectors could benefit from the Covid-19 crisis. The pre-crisis positive trend in information and communication technologies (ICT) and FinTech is being accelerated by social distancing requirements. Several African governments have taken steps to move more economic transactions into the digital space. Some have cooperated with mobile money operators during the crisis to lower or abolish the fees on small-scale transfers in order to encourage the use of mobile money over cash. Although some of these measures are temporary and, in the case of mobile money transfers, cut into operators’ revenues, they accelerate the digital transformation and make investments in the sector more attractive.

In 2019, 40 per cent of all greenfield project announcements were linked to natural resources (UNCTAD 2020). The commodity price shocks make such investments less viable and the outlook is most negative for oil exporters, such as Angola or Nigeria, and also for exporters of copper and iron ore (gold is an exception). Recent greenfield data show that mining and quarrying activities have indeed experienced a vast decline of approximately 90 per cent in investment amounts in an average quarter of 2020 compared to the 2019 quarterly average. Similarly, FDI in manufacturing has already taken a significant hit of approximately 76 per cent in investment volumes in an average quarter of 2020 compared to 2019. The severity of the impact varies between manufacturing sectors but can be expected to be most palpable in those linked to resource extraction and in specific global value chains (GVCs) – for example, the automotive sector. Finally, agriculture, while still the backbone of many African conomies, only attracts a tiny portion of the continent’s FDI. Impacts on greenfield FDI in the sector are moderate, as it is less affected by social distancing (Sandefur and Subramanian 2020), and prices for key agricultural commodities such as sugar, cocoa, tea, and coffee are relatively stable or even rising (IMF 2020b).

Policy Implications

The coronavirus pandemic and the associated lockdowns and distancing measures have had severe economic consequences in Africa. However, the impacts differ considerably between countries, the informal and formal sectors, industries, and traded products. The economic and social policy responses should take this heterogeneity of impacts into account. With the notable exception of South Africa, the pandemic appears to be following a somewhat milder trajectory than elsewhere, though this assessment is based on data that are weaker than for other world regions. Strict lockdown policies may have contributed to containing the disease early on, but they have caused great economic damage. Economic support measures, however, have been far more moderate than elsewhere, though the international community has provided additional assistance to African economies.

The most recent economic data suggests that economic activity declined dramatically during the lockdowns. The very sharp decline in South Africa is particularly worrying, as it is likely to affect neighbouring economies as well. At the same time, some countries in West and East Africa are already showing signs of recovery that may take place more quickly than anticipated. Looking solely at African aggregate growth performance and aggregate poverty will be misleading. Short-term impacts, especially on urban poverty, have likely been severe: The evidence is clear that informal workers across the continent have suffered drastic income losses during the lockdowns, as few have been shielded by social protection or other policies. It remains to be seen how quickly they can recover from the shock, but there is some empirical silver lining here as well.

As elsewhere in the world, industries have been affected heterogeneously by the pandemic and the associated restrictions. This also holds for the external sector. Trade has declined dramatically, but our analysis reveals important differences between export products. Oil exporters have been adversely affected by the oil price slump and impacts on products traded in GVCs have been diverse, ranging from strong declines in textiles and apparel to increases in some food products. Food imports have hardly been affected, as global food supply chains have, overall, proven relatively resilient thus far. Finally, FDI is likely to drop substantially in 2020. Although there is again sectoral variation, this drop will not spare investments considered key for an acceleration of Africa’s economic development and the creation of productive employment.

The drop in FDI demonstrates the uncertainty that looms over the hope for quick recovery. Huge setbacks to economic progress and poverty reduction in Africa can only be avoided with a quick recovery. A prolonged economic recession would not only cause poverty to rise further, but the medium- to long-term costs of the shock could be exacerbated by political turmoil or even increased conflict. So what can be learnt from our analysis of the past few months? First, our assessment clearly calls for a targeted and differentiated response to the economic impacts of the pandemic across countries, industries, and affected workers and households. For example, informal urban workers who continue to be affected by restrictions require assistance. At the international level, a concerted effort to support particularly affected economies – for example, South Africa – should be considered. Second, it is now well understood that the pandemic involves difficult choices. It seems that African governments, at least initially, chose a path that put “years of life lost” over “additional poverty years.” The “new normal,” based on enhanced knowledge about the disease and transmission, should probably put more weight on the economic costs of pandemic-related restrictions. Third, quick recovery should be a priority. While calls to see the crisis as an opportunity for change are justified, there may be trade-offs between “building back better” and “building back quicker” if the former involves long-term planning and delays in the disbursement of funds and implementation. Fourth, this is not to say that absolutely anything is useful simply because it is quick. In particular, it is important to avoid the possibility that increased health spending by government and donors fails to address long-term challenges and the sustainability of public service delivery. Fifth, and finally, African governments need to increase their economies’ and citizens’ resilience to (economic) shocks. Putting into place social protection systems that can be used in times of crisis is one important element. Further, the establishment of more targeted – ideally automatic – stabilisers should be considered – for example, a context-adjusted version of Germany’s furlough (Kurzarbeit) scheme.

Fußnoten

Literatur

Balde, Racky, Mohamed Boly, and Elvis Avenyo (2020), Labour Market Effects of COVID-19 in Sub-Saharan Africa: An Informality Lens from Burkina Faso, Mali and Senegal, MERIT Working Papers, 022, 1–38.

Blofield, Merike, Bert Hoffmann, and Mariana Llanos (2020), Assessing the Political and Social Impact of the COVID-19 Crisis in Latin America, GIGA Focus Latin America, 03, April, https://www.giga-hamburg.de/en/publication/assessing-the-political-and-social-impact-of-the-covid-19-crisis-in-latin-america.

Bodewig, Christian, Ugo Gentilini, Zainab Usman, and Penny Williams (2020), COVID-19 in Africa: How Can Social Safety Nets Help Mitigate the Social and Economic Impacts?, World Bank, Washington, DC., https://blogs.worldbank.org/africacan/covid-19-africa-how-can-social-safety-nets-help-mitigate-social-and-economic-impacts (25 September 2020).

Gentilini, Ugo et al. (2020), Social Protection and Jobs Responses to COVID-19: A Real-Time Review of Country Measures, World Bank, Washington, DC., https://openknowledge.worldbank.org/handle/10986/33635 (28 September 2020).

Hale, Thomas, Sam Webster, Anna Petherick, Toby Phillips, and Beatriz Kira (2020), Oxford COVID-19 Government Response Tracker, Blavatnik School of Government, Data Use Policy: Creative Commons Attribution CC BY Standard, https://www.bsg.ox.ac.uk/research/research-projects/coronavirus-government-response-tracker (28 September 2020).

Hartwig, Renate, and Tabea Lakemann (2020), When the Going Gets Tough: Effects of the COVID-19 Pandemic on Informal Entrepreneurs in Uganda, Study within the Research Project “Performance and Dynamics of Micro and Small Enterprises in Developing Countries”, https://www.giga-hamburg.de/sites/default/files/md_pdf/2008_Corona_Spotlight_Uganda.pdf.

Lakuma, Corti Paul, and Sunday Nathan (2020, May 19), Impact of COVID-19 on Micro, Small, and Medium Businesses in Uganda, https://www.brookings.edu/blog/africa-in-focus/2020/05/19/impact-of-covid-19-on-micro-small-and-medium-businesses-in-uganda/ (28 September 2020).

Mbow, Moustapha et al. (2020), COVID-19 in Africa: Dampening the Storm?, in: Science, 369, 6504, 624–626, https://doi.org/10.1126/science.abd3902 (28 September 2020).

Okonjo-Iweala et al. (2020), COVID-19 and Debt Standstill for Africa: The G-20’s Action is an Important First Step that Must Be Complemented, Scaled Up, and Broadened, in: Africa in Focus, https://www.brookings.edu/blog/africa-in-focus/2020/04/18/covid-19-and-debt-standstill-for-africa-the-g-20s-action-is-an-important-first-step-that-must-be-complemented-scaled-up-and-broadened/ (28 September 2020).

Omondi, Domnic (2020), Economy Begins to Snap Back to Life as Flow of Cash Picks up, https://www.standardmedia.co.ke/the-standard-insider/article/2001385618/economy-begins-to-snap-back-to-life-as-flow-of-cash-picks-up (28 September 2020).

Quayyum, Saad Noor, and Roland Kangni Kpodar (2020, September 11), Supporting Migrants and Remittances as COVID-19 Rages On, https://blogs.imf.org/2020/09/11/supporting-migrants-and-remittances-as-covid-19-rages-on/ (25 September 2020).

Sandefur, Justin, and Arvind Subramanian (2020) The IMF’s Growth Forecasts for Poor Countries Don’t Match Its COVID Narrative, Center for Global Development Working Paper, 533, 24.

Schwettmann, Jürgen (2020), Covid-19 and the Informal Economy, Friedrich Ebert Stiftung, Analysis.

Wills, Tom (2020), Coronavirus in Africa: How Deadly Could COVID-19 Become?, DW, 24.04.2020, https://p.dw.com/p/3bLgl. (25 September 2020).

Internet Resources from National and International Institutions

AHK Ghana, and CCI France Ghana (2020), Coronavirus Impact Survey, https://www.ccifrance-ghana.com/news/n/news/corona-virus-impact-survey-may-2020.html (28 September 2020).

AFREC (2020), The Impact of COVID-19 on African Oil Sector, A Special Report by AFREC on the Implications on African Countries, https://au.int/sites/default/files/documents/38601-doc-afrec_report-_covid-19_and_its_impact_on_african_oil_markets-_final_27-05-2020.pdf (28 September 2020).

Bank of Ghana (2020), Statistical Bulletin, https://www.bog.gov.gh/publications/statistical-bulletin/ (28 September 2020).

CCSA (2020), How COVID-19 is changing the World: a Statistical Perspective, https://data.unicef.org/resources/how-covid-19-is-changing-the-world-a-statistical-perspective/ (28 September 2020).

DIHK, and AHK (2020), AHK World Business Outlook Frühjahr 2020, Deutscher Industrie- und Handelskammertag e.V., https://www.dihk.de/resource/blob/22910/f86e930b378f189b78ad22f73f3177f1/ahk-world-business-outlook-fruehjahr-2020-data.pdf (28 September 2020).

Ecofin Agency (2020), Kenya: 2.5mln Jobs Lost in the Tourism Sector due to Covid-19, https://www.ecofinagency.com/public-management/1109-41804-kenya-2-5mln-jobs-lost-in-the-tourism-sector-due-to-covid-19 (28 September 2020).

IMF (2020a), COVID-19 Financial Assistance and Debt Service Relief - sub-Saharan Africa, https://www.imf.org/en/Topics/imf-and-covid19/COVID-Lending-Tracker (28 September 2020).

IMF (2020b), Regional Economic Outlook, April 2020, Sub-Saharan Africa COVID-19: An Unprecedented Threat to Development, https://www.elibrary.imf.org/doc/IMF086/28915-9781513536835/28915-9781513536835/Other_formats/Source_PDF/28915-9781513538495.pdf (28 September 2020).

Kenya National Bureau of Statistics (2020), Leading Economic Indicators July 2020, https://www.knbs.or.ke/?wpdmpro=leading-economic-indicators-july-2020 (28 September 2020).

Nigerian National Bureau of Statistics, and World Bank (2020), COVID-19 Impact Monitoring, https://openknowledge.worldbank.org/bitstream/handle/10986/34402/Third-Round-Results.pdf?sequence=1&isAllowed=y (15 September 2020).

Stats SA (2020), Gross Domestic Product. Second Quarter 2020, http://www.statssa.gov.za/publications/P0441/P04412ndQuarter2020.pdf (28 September 2020).

Ugandan Ministry of Finance Planning and Economic Development (2020), Performance of the Economy Report - August 2020, https://www.finance.go.ug/publication/performance-economy-report-august-2020 (28 September 2020).

UNCTAD (2020), World Investment Report 2020: International Production Beyond the Pandemic, International Investment Report, https://unctad.org/en/PublicationsLibrary/wir2020_en.pdf (28 September 2020).

UNECA (2020a), COVID-19 in Africa - Protecting Lives and Economies, United Nations Economic Commission for Africa, https://repository.uneca.org/handle/10855/43756 (28 September 2020).

UNECA (2020b), Facilitating Cross-Border Trade Through a Coordinated African Response to Covid-19, https://www.uneca.org/sites/default/files/PublicationFiles/facilitating_cross-border_trade_through_a_coordinated_african_response_to_covid-19_fin_4aug.pdf (28 September 2020).

World Bank (2020a), COVID-19 Forced Businesses in Ghana to Reduce Wages for over 770,000 Workers, and Caused about 42,000 Layoffs - Research Reveals, https://www.worldbank.org/en/news/press-release/2020/08/03/covid-19-forced-businesses-in-ghana-to-reduce-wages-for-over-770000-workers-and-caused-about-42000-layoffs-research-reveals (28 September 2020).

World Bank (2020b), Food Security and COVID-19, https://www.worldbank.org/en/topic/agriculture/brief/food-security-and-covid-19 (28 September 2020).

World Bank (2020c), Global Economic Prospects, June 2020, https://doi.org/10.1596/978-1-4648-1553-9 (28 September 2020).

World Bank (2020d, June 19), COVID 19: Debt Service Suspension Initiative, https://www.worldbank.org/en/topic/debt/brief/covid-19-debt-service-suspension-initiative (28 September 2020).

Gesamtredaktion GIGA Focus

Redaktion GIGA Focus Afrika

Lektorat GIGA Focus Afrika

Regionalinstitute

Forschungsschwerpunkte

Wie man diesen Artikel zitiert

Lakemann, Tabea, Jann Lay, und Tevin Tafese (2020), Afrika nach den COVID-19-Lockdowns: wirtschaftliche Auswirkungen und Perspektiven , GIGA Focus Afrika, 6, Hamburg: German Institute for Global and Area Studies (GIGA), https://nbn-resolving.org/urn:nbn:de:0168-ssoar-70106-5

Impressum

Der GIGA Focus ist eine Open-Access-Publikation. Sie kann kostenfrei im Internet gelesen und heruntergeladen werden unter www.giga-hamburg.de/de/publikationen/giga-focus und darf gemäß den Bedingungen der Creative-Commons-Lizenz Attribution-No Derivative Works 3.0 frei vervielfältigt, verbreitet und öffentlich zugänglich gemacht werden. Dies umfasst insbesondere: korrekte Angabe der Erstveröffentlichung als GIGA Focus, keine Bearbeitung oder Kürzung.

Das German Institute for Global and Area Studies (GIGA) – Leibniz-Institut für Globale und Regionale Studien in Hamburg gibt Focus-Reihen zu Afrika, Asien, Lateinamerika, Nahost und zu globalen Fragen heraus. Der GIGA Focus wird vom GIGA redaktionell gestaltet. Die vertretenen Auffassungen stellen die der Autorinnen und Autoren und nicht unbedingt die des Instituts dar. Die Verfassenden sind für den Inhalt ihrer Beiträge verantwortlich. Irrtümer und Auslassungen bleiben vorbehalten. Das GIGA und die Autorinnen und Autoren haften nicht für Richtigkeit und Vollständigkeit oder für Konsequenzen, die sich aus der Nutzung der bereitgestellten Informationen ergeben.