- Home

- Publications

- GIGA Focus

- Trump’s Shadow over US–China Economic Relations

GIGA Focus Asia

Trump’s Shadow over US–China Economic Relations

Number 4 | 2017 | ISSN: 1862-359X

With US President Trump in office for half a year now, some people are still hoping that he will back away from his proclaimed protectionist policies. Given the current mood of populism in the United States, however, we cannot assume that Trump will yield to the pressure from domestic companies with a strong stake in China and return to some kind of “realpolitik.” As a result, trade protectionism, investment barriers, and competition over global technological leadership will likely increase under the Trump administration, opening up new space for cooperation between the European Union and China.

Populists in the United States are blaming globalisation for the loss of jobs and rising economic insecurity. They want to halt the shift of global economic power in favour of other countries.

Trump is accusing China of profiting disproportionally from global free trade. China–US trade disputes within the World Trade Organization framework can be expected to intensify. Concurrently, bilateral trade agreements are preferred by the Trump administration, as it believes the United States can reap trade benefits more effectively this way.

The United States will strengthen its request for better access to the Chinese market, while Chinese direct investment in the United States will come under more pressure. We can expect that China’s acquisitions of US companies with sensitive technology will be further restricted.

The US withdrawal from the Trans-Pacific Partnership (TPP) is expected to lead to a decrease in US economic influence in Asia. The Trump administration seems to prioritise the short-term satisfaction of its populist clientele over the long-term impact on US competitiveness in the Asia-Pacific region.

Policy Implications

Under the Trump administration, we can expect that tension in US–China economic relations will increase. While the United States will remain an important economic partner of the European Union, the latter should use the window of opportunity to strengthen its trade and investment relations with China. Concluding the EU–China Investment Agreement will be an important step in this direction. In the light of Trump’s “America First” policy, the Chinese side might be more willing to enter into this agreement, which will protect investments and facilitate greater market access for European companies.

Little Hope for “Realpolitik”

In her testimony before the US Senate Foreign Relations Committee in September 2015, Melanie Hart, director of China Policy at the Center for American Progress, described the US policy towards China as following a multitrack approach. It “enables the United States to push back against problematic actions as needed without curtailing overall US–China cooperation. This is a realpolitik, eyes-wide-open approach to engagement” (Hart 2015). One and a half years later, the new US government clearly favours an “America First” policy approach and seems to be preparing for a trade conflict. Citing President Trump, Secretary of State Rex W. Tillerson underlined in his remarks at the US–China Summit on 6–7 April 2017 that the “chief goal of our trade policies is the prosperity of the American worker. To that end, we will pursue economic engagement with China that prioritises the economic well-being of the American people” (US Department of State 2017).

Despite this tough stance towards China, Chinese media maintained their rather optimistic attitude. Since Trump’s election, both official and unofficial Chinese commentaries on the Trump administration’s foreign policy have been based on the expectation that the president will take a pragmatic and transactional approach to the Sino–American relationship. When it comes to economic and trade policy, however, the drawbacks of the bilateral relationship are stressed by the Chinese government. Speaking at a press conference on the occasion of the Fifth Session of the 12th National People’s Congress on 3 March 2017, Prime Minister Li Keqiang warned that in the case of a trade war between China and the United States, foreign-invested companies, especially US firms, will bear the consequences.

Judging by the “Joint Release: Initial Results of the 100-Day Action Plan of the U.S.–China Comprehensive Economic Dialogue,” published on 11 May 2017 by the US Department of Commerce, the results of that action plan are relatively unimpressive. Although the plan covers 10 broad areas, including agricultural trade, financial services, investment, and energy (US Department of Commerce 2017), there are no agreements on larger issues. Critics point out that issues such as China’s steel and aluminium overcapacities and its restrictions on technology and unequal treatment vis-à-vis US firms were not touched upon.

Finding a compromise solution for the more sensitive trade and investment issues between China and the United States, however, seems difficult in light of the “America First” policy of President Trump. This populist message, which made his election campaign so successful, was based on the changes in the socio-economic context in the United States. Following Inglehart and Norris (2016), the global rise of populism can be explained by the growing economic inequality caused by a comprehensive transformation of the workforce and by the cultural backlash to a progressive value change. The authors assume that the two sets of changes might have reinforced each other. In the case of the United States, China was blamed for the loss of US jobs and the increase in social insecurity. Halting the shift of global economic power in favour of China was one of Trump’s campaign pledges.

That China’s competitive pressure on US manufacturing industries played a role in Trump’s electoral victory has been shown in various studies of voting patterns in US counties where Chinese imports have risen markedly in the last decade. One of these studies claims that the rising import competition from China contributed to a shift in voting towards candidates representing ideological extremes in those districts, a phenomenon that particularly benefitted Republican candidates (Autor et al. 2016a). The Democrats would have gained a majority of votes in the states of Michigan, Wisconsin, and Pennsylvania if the growth of import competition from China had been only half as large as observed. In contrast, in areas with fewer Chinese imports the “China effect” was marginal.

Against this backdrop, we presume that there is little hope for realpolitik. Due to the changes in the political landscape and the current mood of populism, the Trump administration is going to call into question existing trade relations with its major economic partners, including bilateral, regional, and multilateral trade agreements. China will be the focus of the attempt to redirect trade policies in favour of the US economy. This is the clear message of “The President’s 2017 Trade Policy Agenda,” introduced in March 2017, which says that “while the current global trading system has been great for China, since the turn of the century it has not generated the same results for the United States” (USTR 2017). In order to deliver substantial improvement to those regions and workers in the United States disfavoured by the increase of globalisation, particularly because of China’s import pressure, the current US government will be more assertive and prepared to enforce its “America First” policy.

US–China Trade Relations Under Fire

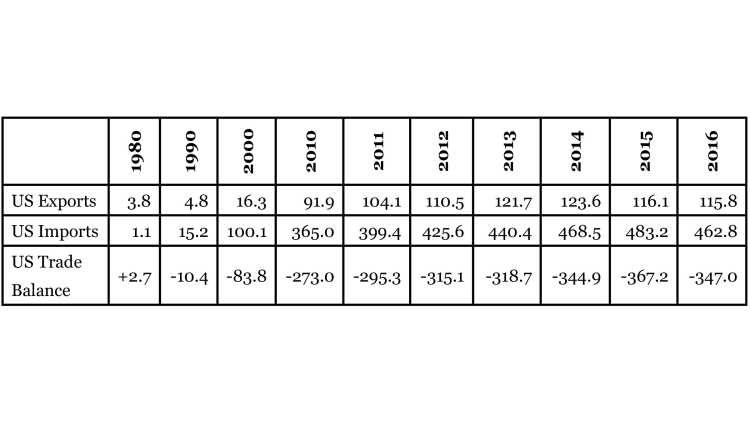

Over the last three decades, US–China trade relations have grown rapidly and become very complex. The countries are now mutually dependent. China is the biggest source of US imports, its third-largest export market, and its second-largest merchandise trading partner. The Chinese market was by far the fastest-growing one for US exports, increasing more than fivefold between 2001 and 2016. Total exports amounted to USD 155.8 billion by 2016. US imports from China grew fourfold during the same period. Starting from a higher baseline, the total imports went up to USD 462.8 billion, resulting in a US trade deficit of USD 347 billion in 2016 (see Table 1). This deficit with China is significantly larger than that with any other US trading partner and has repeatedly been used to criticise China for its unfair trade practices.

Critics of this trade deficit point to the bilateral trade structure as a sign of the declining competitiveness of the United States compared to China’s rising competitive position. US imports from China mainly consist of industrial products. The top five products are communications equipment, computer equipment, miscellaneous manufactured commodities (such as toys and games), apparel, and semiconductors and other electronic components. Among the imports from China, advanced technology products (ATP) represent a large and growing share. Trade in this category increased from USD 21 billion in 2003 to USD 114.2 billion in 2016. Currently, more than one-third of total ATP imports into the United States come from China. Information and communications technology (ICT) products account for the largest share of these imports. By contrast, US agricultural exports occupy a central position in trade with China, which represents the second-largest market for US agricultural exports. In 2016 the value of US exports of oil seeds and grains (mainly soya beans) was higher than the export value of aerospace products (mainly civilian aircraft and parts), which belong to the second-most important product category. Other major US exports to China were motor vehicles, semiconductors and electronic components, and navigational, measuring, medical, and controlling instruments (Morrison 2017: 4, 8–9).

Academic discussion in the United States has partly supported the “2017 Trade Policy Agenda” of the Trump administration by complaining that imports from China have market-distorting effects in the United States. One example is a study by Autor, Dorny, and Hanson (2016), entitled “The China Shock.” It shows American workers in regions that were particularly affected by Chinese import competition suffering from unemployment and economic insecurity. These workers rarely found adequate substitutes for job losses; their income generally shrank. They often became ill, had difficulties finding a spouse, and died earlier. Another study (Autor et al. 2016b) found an additional negative impact of the market-distorting imports from China – namely, the reduction of R&D spending by US companies. Not many US firms tried to be more innovative in response to Chinese import penetration. Although the aforementioned studies have been criticised for their methodological limitations, they provided important arguments for the Trump administration to re-evaluate the gains and losses related to liberalised trade.

In the “2017 Trade Policy Agenda,” fairness in trade relations plays a crucial role. The goal is to have trade relations that are “freer and fairer for all Americans,” promote jobs in the United States, strengthen the national manufacturing base, and expand US agricultural and service-industry exports. The policy agenda stresses that these goals will be better achieved through bilateral rather than multilateral negotiations, including the renegotiation and revision of existing trade agreements. Major areas of concern include restrictions that US industrial and agricultural exports face abroad, unfair advantages through subsidies, theft of trade secrets, and currency manipulation. The “2017 Trade Policy Agenda” singled out China as one of the major sources of the US decline of manufacturing production and jobs and announced its intention to renegotiate trade agreements with China, South Korea, and Mexico. Within the WTO, the Trump administration appears to reinforce the WTO dispute settlement against China’s unfair trade practices. However, the administration does not want the multilateral trading system to restrict American sovereignty over its own trade policy. The “2017 Trade Policy Agenda” underlines that if the WTO dispute settlement body rules against the United States, this would “not automatically lead to a change in the US law or practice.” Although the US administration has not yet started to employ its new policy agenda, changes could come about quickly. The American trade law provides the president with broad authority to implement trade-related measures such as terminating trade agreements or imposing punitive duties for a period of up to 150 days without involving Congress.

If this should happen, however, the Chinese trade negotiators would certainly retaliate as they have in the past. When former US president Barack Obama announced new duties on imports of Chinese tires under Section 421 of US trade law, the Chinese authority retaliated within 48 hours by initiating anti-dumping investigations of US cars and poultry. While conflicts within the WTO-sanctioned tit-for-tat are not something trade experts are worried about, it is the bypassing of WTO rules that could lead to a trade war between America and China. Should the Trump administration apply punitive tariffs to China, for example, foreign experts expect an immediate retaliation that would be directed at imports of strategic importance for the United States, such as soya beans.

Slowdown of US Investments in China

US–China investment relations have been growing rapidly, and so have the discussions over investment restrictions in each other’s markets. China’s investment in the United States includes the holdings of securities, corporate investment (foreign direct investment, FDI), and other non-bond investments (Morrison 2017: 18). At the end of 2016, China held nearly USD 1.06 trillion in US Treasury securities, making it the second-largest foreign US Treasury securities holder. Following the United States–China Economic and Security Review Commission report, Chinese holdings of US government securities do not constitute a security risk for the United States. When China reduced these holdings recently there was only a limited impact on the US economy.

The fast increase of Chinese investment in the US corporate sector is, however, a subject of greater concern. Based on statistics from the US Bureau of Economic Analysis (BEA), the main US government agency responsible for collecting and reporting data on FDI flows to and from the United States, US companies invested USD 7.3 billion in China in 2015; this was 4.2 per cent less than in 2014. China was the tenth-largest destination of US FDI outflows. At the same time, Chinese FDI flows to the United States are rapidly catching up and accounted for USD 5.1 billion in 2015, an increase of 155.2 per cent over 2014. China was the twelfth-largest source of US FDI inflows in 2015 (Morrison 2017: 21). The stock of US FDI in China (accumulated investment) is much higher than vice versa, since China’s outward direct investment is a relatively new phenomenon. Estimates on Chinese FDI stocks in the United States vary greatly across different agencies. Data on Chinese investment stocks published by the Rhodium Group, a private consulting firm, are significantly higher than BEA estimates, but point to similar trends in US–China investment relations. While Chinese corporate investment in the United States has been growing strongly since the financial crisis, US FDI in China remains below 2008 levels.

The US government ascribes the stagnant investment level to restrictions on market access in China. Many US business groups believe there has been an uptick in protectionism in China. According to a survey by the US–China Business Council (USCBC) in 2016, the main reason that companies reduced or halted planned investment in China in the past year was the perception of increasing restrictions on market access. The China business-climate survey conducted by the American Chamber of Commerce in China (2016) found that 16 per cent of the survey respondents, especially those in the technology and R&D-intensive sectors and services, saw market-access barriers or government policies that disadvantage foreign companies as being the primary reason for a decline of their investment in China. More than three-quarters (77 per cent) of the respondents perceived foreign businesses in China as being less welcome than before. Compared to the 2013 survey, in which the corresponding share was 41 per cent, the perception of the respondents became significantly more negative. A large majority of companies expected that the US–China bilateral investment treaty (BIT), which has been under discussion since 2008, would improve the situation. US industry hopes that the BIT will lead to more transparency, predictability, and a level playing field with domestic Chinese companies, and that it will limit the use of industrial policies that created market-access barriers for foreign companies.

There is also growing concern that China’s programmes for the promotion of indigenous innovation will discriminate against American companies in China. To reduce the country’s dependence on foreign technology and transform China from a global centre of low-tech manufacturing into a major centre of innovation, the Chinese government introduced its Made in China 2025 programme in 2015. This programme can be regarded as a continuation of the National Medium- and Long-Term Program for Science and Technology Development (2006–2020), which also focused on the strengthening of China’s indigenous innovative capabilities. Although the Chinese central government promised that measures linking innovation policies to government procurement preferences would be forbidden, US companies are still concerned over whether foreign intellectual property rights can be protected (Morrison 2017: 33–34). Another concern is China’s restriction on ICT, which the Chinese justify by citing national security issues, but which US companies view as a strategy to limit the growth of US ICT companies (such as cloud computing) operating in China.

More Restrictions on Chinese Investment in the United States

Restrictions on Chinese corporate investment in the United States have been stepped up. The Committee on Foreign Investment in the United States (CFIUS) is authorised to review transactions that could result in control of a US business by a foreign investor. Investigations are conducted in order to determine the effect of such transactions on US national security. Over the last few years, acquisitions of US assets, particularly of US technology firms by Chinese companies, became the main target of CFIUS investigations. Between 2012 and 2014, transactions by Chinese investors represented 19 per cent of the total number of reviewed transactions. About half of the investigations were conducted in the manufacturing sector (Jackson 2017: 20).

According to the Information Technology and Innovation Foundation (ITIF), an influential US think tank, CFIUS and its investment review process should be reformed. In the hearing on “Chinese Investment in the United States,” the president of ITIF, Robert D. Atkinson, estimated that at least one-third of the investment comes from Chinese state-owned enterprises that are guided and supported by the Chinese government to target industries of strategic importance for the national security of the United States or its economic leadership. Atkinson argues that many acquisitions only serve the aim of taking over US technology in order to gain global market shares. He offers a simple solution to that challenge: “Without access to US technology and know-how, the process by which China gains and ultimately surpasses the United States in technology capabilities will be delayed substantially” (ITIF 2017: 2). Along the same lines reads a Pentagon report commissioned by the former secretary of defence, which points out that Chinese companies invested approximately USD 30 billion into early-stage technology through more than 1,000 funding deals between 2010 and 2016. China became an important participant in total venture deals; its share rose to approximately 10 per cent. The investment focused on strategic technologies such as artificial intelligence and robotics and has potential military applications. In the battle for global leadership in science and technology it can be expected that the United States will continue to push for mutual access and equal treatment in investment relations with China, support analytical competence within the US administration, and cooperate with its allies in the design of policy measures that “constrain mercantilist-inspired Chinese FDI” (ITIF 2017: 3).

In sum, we expect that bilateral investment relations will undergo significant changes as well. On the one hand, the Trump administration will certainly increase the pressure on China in terms of allowing US investors access to the Chinese market, lifting barriers to entering still-protected industries, and solving conflicts over technology licensing between the United States and China (ITIF 2017: 7). On the other hand, CFIUS’s investigations might be extended to include 1) the impact of acquisitions by Chinese investors on US economic and technology leadership in strategic industries and 2) investment activities of Chinese venture capital funds. US experts distinguish the new approach with China from approaches with other countries. China’s corporate investment in high-tech industries follows the strategy of global knowledge acquisition. This works to the disadvantage of the United States: “When you compare it with Japan, the differences are obvious: China is a lot bigger economy, it’s not an ally, and it’s not a democracy. The plans coming out of the Chinese government and the statements coming out of the Chinese leadership have a clear mercantilist bent and connection to China’s national-security strategy” (Kuo 2017).

A Growing Economic Role for China in the Asia-Pacific Region?

While increasing frictions are to be expected in the areas of US–China trade and investment relations, the US withdrawal from the Trans-Pacific Partnership (TPP), one of the first policy decisions undertaken by President Trump, could lead to a relaxation of existing tensions in the bilateral relationship. This decision was explained in “The President’s 2017 Trade Policy Agenda” as a clear signal that “the United States would take a new approach to trade issues.” The agenda announced that “bilateral talks with the remaining TPP countries” will be started to negotiate a new agreement (USTR 2017: 6). Most analysts agree that the withdrawal from TPP will reduce US influence in Asia and work in favour of China as the regional power.

As Asia has, economically speaking, long been the fastest-growing region in the world, the US administration under President Bush began talks in 2008 on a regional trade agreement between the United States and 11 countries in the Asia-Pacific region, which subsequently morphed into the TPP. Under the Obama administration, the TPP became part of the larger “Pivot to Asia” policy that aimed to strengthen the position of the United States in the Asia-Pacific. The implication is beyond US economic interests in the region. That China was excluded from participation in the TPP was seen as a signal to China that the United States wanted to use trade agreements as a means to contain China. In line with this approach is the comment by former president Obama in 2015 that the “TPP allows America – and not countries like China – to write the rules of the road in the twenty-first century” (Ford 2017). One of the key objectives of the TPP was the creation of a “level playing field” for US companies in the Asia-Pacific region. The negotiation covered a wide range of topics, including certain restrictions on state-owned enterprises, the introduction of market rules, protection of foreign investors against unfair government procurement contracts and infringement on intellectual property rights, and the enhancement of social and labour protection standards. The exclusion of China from this agreement would have worked to China’s disadvantage.

The economic benefits to the United States from the TPP would have been manifold. First, the total benefit from trade integration has been projected to grow from USD 5 billion in 2015 to USD 14 billion in 2025. With the TPP seen as a pathway to an Asia-Pacific free trade agreement and under the assumption that Canada, Japan, and Mexico would join as well, the size of the market and thus the economic benefit for the United States would have been even larger. In addition to benefits coming from regional trade integration, US services exports would have also been expected to strongly increase. A positive impact was also projected for the manufacturing sector and for small businesses. Most of all, the TPP would have strengthened US leadership in setting trade and investment rules in the region.

Given the huge strategic and economic benefits related to the TPP, why then was President Trump so eager to withdraw from the agreement? After all, the TPP was supported not only by many liberals – because labour rights and environmental protections were included in the agreement – but also by strong lobbying groups such as the US Chamber of Commerce and the National Association of Manufacturers. At a press conference, Trump gave an explanation that was in line with the new policy approach, arguing that existing trade agreements would not protect jobs in the United States: “We’re going to stop the ridiculous trade deals that have taken everybody out of our country and taken companies out of our country, and it’s going to be reversed.” Trade agreements, he said, would only be made with individual allies in the future (Baker 2017). The withdrawal from the TPP has a number of implications for the United States. We believe not only that the 11 would-be partner countries from the Asia-Pacific are disappointed in the decision but also that this step will increase those countries’ doubts about the role of US leadership in the region. The Trump administration’s retreat could be the cause of more economic and political tension among the countries in Asia and work against the strategic US interests of shaping the region based on liberal values and open markets.

Critical comments on Trump’s decision to withdraw from the TPP point to the negative impact on the US economic position in the Asia-Pacific region. Under the heading “The Death of TPP: The Best Thing that Ever Happened to China,” Wayne and Magnusson (2017) pointed to the missed opportunity to reinvigorate US trade and economic influence in the Asia-Pacific region. Based on World Bank trade data for the region, they showed that at least 17 countries in the Asia-Pacific increased their imports from China, while decreasing their imports from the United States. Canada, Japan, and Mexico were among the countries whose trade balance shifted in favour of China. The TPP could have supported the recovery of the US economic position vis-à-vis these countries.

In sum, the withdrawal from the TPP demonstrates that the Trump administration is not striving for a realpolitik approach, but wants most of all to execute its populist campaign pledges. Instead of expanding its long-term influence in the Asia-Pacific region, the Trump administration seems to prioritise the short-term satisfaction of its domestic clientele.

Policy Implications for the European Union

Trump’s “America First” policy calls the existing structure of economic relations with China into question. With the United States and China being among the most important trading partners of the European Union, any US restrictions on trade with China will be felt in the European countries. China is strongly involved in the global value chain, and many European companies have production sites in China. Therefore, an increase of tariff and non-tariff barriers by the United States would represent a challenge for European outward-oriented economies, especially Germany. Based on estimates, approximately 80 per cent of global trade is supply-chain trade, making the traditional calculation of national trade deficits obsolete.

Seen from the European perspective, trade competition from China is putting pressure on European companies, but the growing Chinese market also provides huge opportunities for European suppliers. Given the competitive pressure from China, national governments within the European Union should continue to support the industrial restructuring of those regions with outdated industries that are facing challenges posed by globalisation and by China. Most European countries have no reservations employing policies that would engender economic restructuring. By contrast, an active industrial policy is not very popular in the United States. Under the Trump administration, the United States will be further “protected” against foreign competition. Although a more protectionist policy is welcomed in those Midwestern and Southern states that elected Trump in 2016, this policy will not solve the structural problems and the decline of US competitiveness.

The European Union should strongly support the WTO’s function as the most important global institutional structure that provides the means to deal with trade conflicts between the European Union and China. The investment relations with China can be improved by concluding the EU–China Investment Agreement, which has been under negotiation since 2013. This agreement will not only protect investments but also facilitate greater access to the Chinese market. In his speech at the Davos Forum, Xi Jinping already announced that some of the barriers for European countries to the Chinese market will be removed. Most experts expect that China will be more willing to compromise on some of the most controversial topics of the agreement. In contrast to the short-term gain approach that the Trump administration is pursuing in order to satisfy its populist clientele, the European Union should follow a long-term strategy in its relations with China. This would include not only a free trade agreement further down the line, but also closer cooperation in science and technology.

Footnotes

References

American Chamber of Commerce in China (2016), 2016 China Business Climate Survey Report, www.iberchina.org/files/2016/amchan_china_climate_2016.pdf (1 June 2017).

Autor, David H., David Dorny, and Gordon H. Hanson (2016), The China Shock: Learning from Labor-Market Adjustment to Large Changes in Trade, in: Annual Review of Economics, 8, 205–240, www.ddorn.net/papers/Autor-Dorn-Hanson-ChinaShock.pdf (20 May 2017).

Autor, David H., David Dorny, Gordon H. Hanson, and Kaveh Majlesi (2016a), Importing Political Polarization? The Electoral Consequences of Rising Trade Exposure, www.ddorn.net/papers/ADHM-PoliticalPolarization.pdf (1 June 2017).

Autor, David H., David Dorny, Gordon H. Hanson, Gary Pisano, and Pian Shu (2016b), Foreign Competition and Domestic Innovation: Evidence from U.S. Patents, https://economics.mit.edu/files/11708 (1 June 2017).

Baker, Peter (2017), Trump Abandons Trans-Pacific Partnership, Obama’s Signature Trade Deal, in: New York Times, 23 January, www.nytimes.com/2017/01/23/us/politics/tpp-trump-trade-nafta.html (1 June 2017).

Ford, John (2017), The Pivot to Asia Was Obama’s Biggest Mistake, in: The Diplomat, 21 January, http://thediplomat.com/2017/01/the-pivot-to-asia-was-obamas-biggest-mistake/ (9 June 2017).

Hart, Melanie (2015), Assessing American Foreign Policy Toward China, Center for American Progress, 29 September, www.americanprogress.org/issues/security/reports/2015/09/29/122283/assessing-american-foreign-policy-toward-china/ (9 June 2017).

Inglehart, Roland F., and Pippa Norris (2016), Trump, Brexit, and the Rise of Populism. Economic Have-Nots and Cultural Backlash, Harvard Kennedy School, Faculty Research working Paper Series, August, RWP 16-026.

ITIF (Information Technology and Innovation Foundation) (2017), Testimony of Robert D. Atkinson, President Information and Innovations Foundation before the U.S.-China Economic and Security Review Commission, Hearing on Chinese Investment in the United States: Impacts and Issues for Policymakers, 26 January, Washington, DC.

Jackson, James K. (2017), The Committee on Foreign Investment in the United States (CFIUS), 6 April, https://fas.org/sgp/crs/natsec/RL33388.pdf (30 May 2017).

Kuo, Mercy A. (2017), CFIUS in US-China Relations. Insights from Matthew P. Goodman, in: The Diplomat, 25 April, http://thediplomat.com/2017/04/cfius-in-us-china-relations/ (9 May 2017).

Morrison, Wayne M. (2017), China-U.S. Trade Issues, CRS Report Prepared For Members and Committees of Congress, https://digital.library.unt.edu/ark:/67531/metadc958710/m2/1/high_res_d/RL33536_2017Jan04.pdf (30 May 2017).

US Department of Commerce (2017), Joint Release: Initial Results of the 100-Day Action Plan of the U.S.-China Comprehensive Economic Dialogue, 11 May, www.commerce.gov/print/3122 (9 June 2017).

US Department of State (2017), Remarks on China Summit, 6 April, www.state.gov/secretary/remarks/2017/04/269540.htm (9 June 2017).

USTR (United States Trade Representative) (2017), The President’s 2017 Trade Policy Agenda, March, https://ustr.gov/sites/default/files/files/reports/2017/AnnualReport/Chapter%20I%20-%20The%20President%27s%20Trade%20Policy%20Agenda.pdf (9 June 2017).

Wayne, Earl Anthony, and Oliver Magnusson (2017), The Death of TPP: The Best Thing That Ever Happened to China, in: The National Interest, 29 January.

General Editor GIGA Focus

Editor GIGA Focus Asia

Editorial Department GIGA Focus Asia

Regional Institutes

Research Programmes

How to cite this article

Schüler-Zhou, Yun, and Margot Schüller (2017), Trump’s Shadow over US–China Economic Relations, GIGA Focus Asia, 4, Hamburg: German Institute for Global and Area Studies (GIGA), http://nbn-resolving.de/urn:nbn:de:0168-ssoar-52249-1

Imprint

The GIGA Focus is an Open Access publication and can be read on the Internet and downloaded free of charge at www.giga-hamburg.de/en/publications/giga-focus. According to the conditions of the Creative-Commons license Attribution-No Derivative Works 3.0, this publication may be freely duplicated, circulated, and made accessible to the public. The particular conditions include the correct indication of the initial publication as GIGA Focus and no changes in or abbreviation of texts.

The German Institute for Global and Area Studies (GIGA) – Leibniz-Institut für Globale und Regionale Studien in Hamburg publishes the Focus series on Africa, Asia, Latin America, the Middle East and global issues. The GIGA Focus is edited and published by the GIGA. The views and opinions expressed are solely those of the authors and do not necessarily reflect those of the institute. Authors alone are responsible for the content of their articles. GIGA and the authors cannot be held liable for any errors and omissions, or for any consequences arising from the use of the information provided.