- Home

- Publications

- GIGA Focus

- United States–China Decoupling: Time for European Tech Sovereignty

GIGA Focus Asia

United States–China Decoupling: Time for European Tech Sovereignty

Number 7 | 2020 | ISSN: 1862-359X

China’s rise as a global technology power is challenging United States supremacy in many ways. Although the relationship between the US and China has seen its ups and downs over the years, it is only since 2017 that the US’s relations with China have shifted from engagement to confrontation. Little change can be expected under the Joe Biden presidency. Europe is caught in the crossfire of this conflict, and needs to design its own technology policy.

The US still has a leading position globally in major key technologies, but China’s success in catching up and its growing competitiveness in emerging technologies is challenging the US’s leadership role.

In order to contain China’s technological rise, perceived as a threat to its national economy and its security, the US government under President Donald Trump had taken specific policy measures – including screening Chinese investment in the US, new export restrictions, and limiting knowledge transfer to China.

These restrictions have disrupted the technology supply chains of Chinese companies, but spurred their efforts to improve research and technology performance at the same time.

European companies have been concerned about the interruption of global supply chains due to the US–China tech “Cold War,” as well as worried about the associated costs of dealing with two separate technology blocs in the future.

The incoming US government aspires to closer cooperation with its traditional allies on issues related to its “strategic competition” with China. The European Union has to decide whether to join a US-led anti-China tech alliance or design an independent China tech policy instead.

Policy Implications

As both the US and China are of similar economic importance to the EU, taking sides in the geopolitical rivalry between the two superpowers will come at a high cost for Europe – and especially for European companies. The EU should rely more on its counterbalancing power and aim at higher tech sovereignty, while striving for multilateral, open, and rule-based technological cooperation.

Battle for Technological Leadership

China’s technological rise represents a challenge to the current leading economies of the world, especially the United States. While the latter wants to maintain its technology leadership position, China strives for reducing its dependence on US-based technologies and aspires to leadership in emerging technologies. During President Donald Trump’s four-year term, containment of China’s technological development became a top priority of US policy. Some US media outlets and scholars called this technological competition a “technology Cold War.” That the US government decided to prevent the Chinese information technology manufacturer Huawei from using US technology to design or produce semiconductor chips in May 2020 represents a major severance in the technology supply chains that bind the two countries together. Technology decoupling is expected to become a defining feature of the strategic competition between China and the US, and will have a strong impact on Europe in turn.

The US’s restrictions on technology transfers have put Chinese companies under huge pressure, at least temporarily. In areas such as semiconductor equipment and manufacturing, electronic automation tools, CPUs (central processing units) and GPUs (graphics processing units, which perform rapid mathematical calculations), field-programmable gate arrays (integrated circuits designed to be configured by customers or designers after manufacturing), and networking software, China still lags behind (Hoecker, Li, and Wang 2020: 54). Regarding artificial intelligence (AI), China is ranked second globally in terms of academic research, patents, investment, labour, and hardware, but the US still dominates nevertheless. In the longer run, however, we doubt whether China’s technological progress can ultimately be contained.

The rapid increase in China’s technological strength is related to a number of factors. First, the restructuring of its science and technology (S&T) system since 2012 has increased institutional efficiency by solving coordination problems on the horizontal level of governance. Second, the strong increase in spending by government and business on research and development (R&D) and on the improvement of major public-research infrastructure has provided new incentives for scholars, science administrators, and companies alike. Third, international cooperation on S&T has supported the catching-up process and strengthened China’s innovation capacities. Fourth, industrial policies have protected home-grown tech companies in many fields, especially in information and communication technologies (ICT). Without these policies China’s tech giants such as Huawei, a global leader in telecommunications-network equipment, or Alibaba, the third-largest infrastructure-as-a-service business, would not have emerged. Another success story is the rise of Chinese smartphone companies (Hoecker, Li, and Wang 2020: 54); four of them (Huawei, Oppo, Vivo, and Xiaomi) are counted among the six-largest ones worldwide. Some Chinese firms’ research and industrial products can be considered to be leading-edge: namely, telecommunications (5G), mobile devices, commercial drones, high-speed rail, wind turbines, supercomputers, quantum computing, space-launch vehicles and satellites, and liquid crystal displays (LCDs).

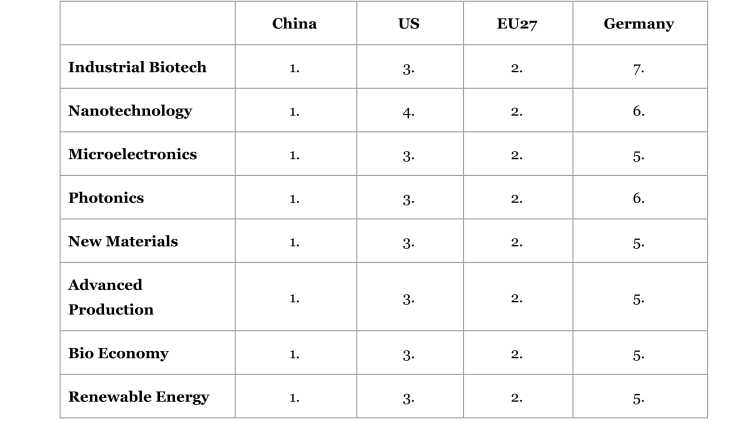

In recent years, China has established a leading position when it comes to scientific publications. Scientific research on major future technologies shows that China ranked first as a major provider of publications in these fields, ahead of both the US and the European Union in 2018 (see Table 1 below). This strong scientific performance makes China very attractive as a knowledge centre for any country wanting to collaborate with some of the best scientists working on future technologies in such fields as bio- and nanotechnology, microelectronics, photonics, new materials, and renewable energy.

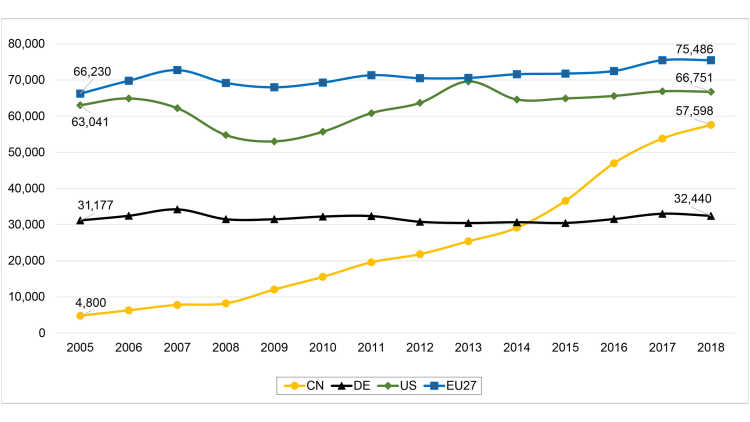

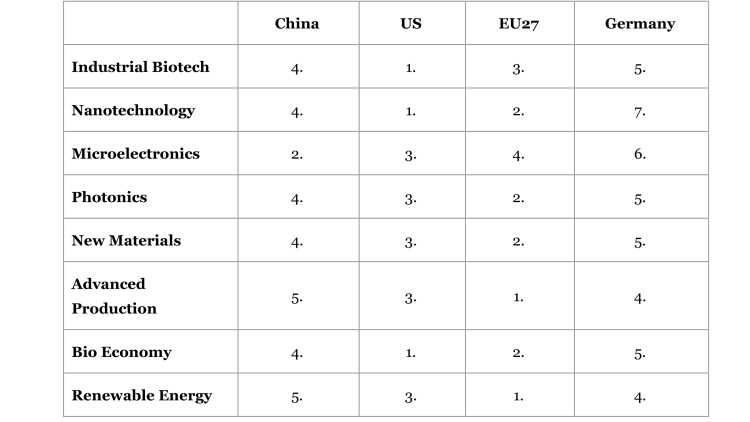

Patents are one of the commonly used indicators for technological development, especially those applied for via and registered with international patent offices. China’s performance regarding transnational patent applications has been quite impressive when comparing the 4,800 made in 2005 with the 57,598 submitted in 2018. Despite this rapid development, transnational patent performance in the EU27 and the US is still ahead of that in China (see Figure 1 below). China’s transnational patent performance vis-à-vis future technologies shows similar results, with the US and the EU still occupying leading positions globally (see Table 2 below).

High-tech exports are another indicator of technological performance. Following the Organisation for Economic Co-operation and Development (OECD) definition of high-tech exports as the exporting of goods that are R&D-intensive, China’s share in global value added of R&D-intensive exports amounted to 21 per cent in 2018. In comparison, the share of the US was 32 per cent while the EU’s was 19 per cent in the same year (Hammer and Yusuf 2020: 24). In sum, the US is not only a stronger performer when it comes to transnational patent registration and global high-tech exports but, as discussed above, also holds a monopoly position regarding key technologies too.

Becoming technologically independent was one of the major goals of China’s S&T policies during the last decade. Ambitious government programmes were designed to realise the long-term vision of achieving a global leadership position in science, technology, and innovation by the year 2050. By that time China wants to become the international hub of science and innovation, being attractive to the best talents and international scholars, and to possess internationally leading research institutes, universities, and innovative companies (Frietsch et al. 2019: 56–57). The US’s various containment policies of late have incentivised the Chinese leadership to further strengthen its support for science and innovation in order to reach that goal. In the recently published draft proposals of the 14th Five-Year Plan (FYP) for the years 2021–2025, the Chinese government placed innovation at the centre of the country’s development plan and defined S&T independence and self-reliance as “strategic pillars” (战略支撑) (China State Council 2020). Similar to the “Made in China 2025” (MIC) plan, this FYP and the included long-term vision up until 2035 reveal ambitious goals: China wants to become a global standards-setter for emerging technologies such as regarding 5G, the Internet of things, and AI.

The US Containment Policy of Recent Years

While China’s transition to an innovation-driven economy has been strongly supported by international organisations like the World Bank or the OECD, it was the presentation of its MIC plan regarding industrial policy in 2015 that would rattle government officials and companies in other countries – and especially in the US. With this policy focusing on high-tech endeavours in fields like aerospace, robotics, and ICT, the US government saw a threat to its technological leadership and condemned it as “economic aggression.” Schneider-Petsinger et al. (2019: 7) point to another reason for the harsh criticism from the US: many of these MIC technologies can be used both for civilian and military purposes, their dual-use nature thus representing a security threat to the US.

There seems to be a general consensus in the US that China’s growing scientific and technological strength creates competition, and even threatens US global leadership. There are, however, wide-ranging differences with regard to specific countermeasures and to the coordination of the different interests at stake. The former principal advisor to President Barack Obama on Asia, Jeffrey Bader, pointed out in the report “A framework for U.S. policy toward China” compiled for the think tank Brookings in 2016 that the US has three options in its competition with China: accommodation, containment, or global cooperation paired with regional resolve. In terms of economic relations between the US and China, Boustany and Friedberg (2019) – both principal investigators of the so-called Taskforce on Transforming the Economic Dimension of U.S. China Strategy – present four possible options meanwhile. They describe initial economic relations prior to 2017 as follows: “The US economy [is] comparatively open and the Chinese economy relatively [open], and in certain respects increasingly closed.” This situation (“status quo”) was understood as a challenge to the US’s both economy and security. Since 2017, the Trump administration has tried to force China towards more openness by imposing import tariffs on the one hand, and by closing off part of its economy to China as well as tightening inward investment monitoring and export controls on the other. These policies have led to a “partial disengagement” of the two countries. The decline in trade activity, investment, exchanges of people, and technology transfer indicates that both countries are moving towards a complete decoupling – a Cold War. Such a breakdown in relations will hurt both China and the US in the near term.

Already during Obama’s presidency, the US government repeatedly prevented Chinese companies from investing in its high-tech industries such as semiconductors because of the dual-use nature of related technologies and their potential negative impact on national security. The Trump administration substantially reformed the review mechanisms of the Committee on Foreign Investment in the United States. In August 2018, the Foreign Investment Risk Review Modernization Act, an annex to the National Defense Authorization Act for fiscal year 2019, came into effect. Based on this bill, more stringent reviews and restrictive measures on Chinese companies investing in high-tech industries through minority equity and other means can be implemented.

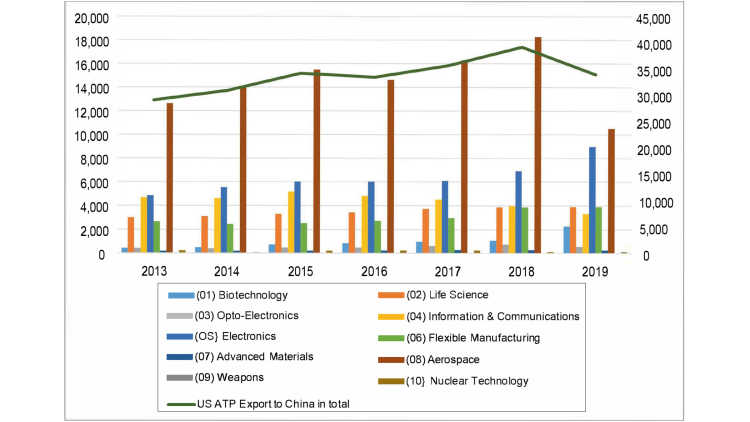

The US government has also gradually strengthened its export-control system. In 2018, the Export Control Reform Act was announced to further restrict the export of technology products to China. In the same year, the Bureau of Industry and Security of the U.S. Department of Commerce formulated an export-control framework for the major key technologies and products. It was clearly targeting China’s high-tech-industry planning. Even high-tech products made by Chinese companies in the US are covered by these regulations. In addition, the US government has increased the enforcement of the export-control law to crack down on so-called technology theft and other legal violations by Chinese companies. As a result, total US export of goods containing advanced technology products (ATPs) to China declined by 13 per cent in 2019. Aerospace as well as ICT products were affected most. In 2019, the US reduced its export of aerospace products to China by 42.5 per cent (see Figure 2 below). According to the U.S. Census Bureau, these goods “encompasses most new military and civil helicopters, airplanes, and spacecraft with the exception of communications satellites that are included under information and communications technology. Other products included are turbojet aircraft engines, flight simulators, and automatic pilots” (U.S. Census Bureau adv). The export of ICT products to China has declined since 2016. In 2019, it shrank by almost 16 per cent (see Figure 2 below). Not included are dual-use goods and technologies that are subject to US export controls and precluded from export to China.

In recent years the US’s containment policy has been extended to the academic field as well, rendering the exchange of students and scholars more difficult. US universities have long played a leading role in relations between their country and China. Between 2009 and 2019, Chinese students enrolled in the US surged in number from 127,628 to 369,548 – thus accounting for the single-largest group of international students enrolled there (EducationData.org). They have also become an important source of revenue for US universities. The majority of Chinese students in the US are self-funded, and they contributed for example almost USD 15 billion in 2018 to the total tuition revenue of public universities. A minority of them have been criticised for having participated in “state-backed technology transfer programs” (Lloyd-Damnjanovic and Bowe 2020: 8). The authors blame these students for having leveraged “the resources of American universities to provide the technology and talent Beijing needs to win its national competition with the United States” (Lloyd-Damnjanovic and Bowe 2020: 4).

Supporters of a decoupling policy call for further restrictions on academic and personnel exchanges between China and the US. In their report “Chinese Influence and American Interests: Raising Constructive Vigilance,” Diamond and Schell note that “the asymmetry of scholarly research access is the most glaring example of the lack of reciprocity” (2018: XI). While normal scholarly activities such as access to archives or libraries and conducting interviews with governmental officials or ordinary citizens are open to Chinese researchers in the US, the latter’s researchers, in contrast, have often seen their academic freedom restricted in China.

New US Government, New China Policy?

Given that current US–China relations are in dire straits, the question at hand is whether and to what extent the newly elected US president, Joe Biden, will follow the same or a different approach to China once in office. During his presidential campaign Biden claimed in a contribution to the journal Foreign Affairs in March 2020 that the US needs to get tough with China. A detailed China strategy for his presidency has, however, not yet been published, so that we have to rely on expert opinions instead. There are essentially two different assessments put forward with regard to Biden’s China policy. Brunnstrom and Pamuk (2020) summarise the opinions of various scholars and former diplomats, arguing based upon them that Biden will follow a tough approach to China. His China policy would, however, refrain from the outright confrontation that President Trump had preferred in recent years, emphasising instead “strategic competition” and the engagement of allies. Alex Doherty’s comments in The Guardian from 12 October 2020 on Biden’s approach to China are in line with this view. He expects that the ascent of a Democratic presidency will not halt the slide towards a new Cold War. In contrast to the Trump administration, the Democrats will be more able to weaponise the issue of human rights to form an international anti-China alliance.

In contrast to the opinion that the Biden administration will proceed with a tough approach to China, M. K. Bhadrakumar (a former Indian diplomat) expects that a more constructive China policy will be pursued by the incoming president. He argues in his contribution to Asia Times of 11 November 2020 that President Trump’s strategies of trade war, technological blockade, and ideological attack have failed to achieve significant results. Second, it would be unrealistic for the US to enter into an economic war or military confrontation; third, COVID-19’s negative impact on the US economy has made the Chinese market even more important for the US’s post-pandemic recovery. He predicts, however, that especially in high-tech fields the hitherto fierce competition between the US and China will endure.

The nomination of Antony Blinken as secretary of state by the president-elect on 23 November of this year provides another clue to the China policy that the Biden administration will pursue. Blinken will be at the forefront of that policy. He is an Obama-era politician who has previously served as deputy secretary of state. Isaac Stone Fish, a senior fellow at Asia Society, expects him to re-engage US allies and align them behind the US’s chosen China approach. Although the Biden presidency will continue to be tough on China, Blinken stands also for more engagement with the Asian country. During a Chatham House webinar broadcasted on YouTube on 30 April 2020, Blinken opted for the development of a better relationship with China. With the European countries counting among the most important allies of the US globally, the question arises whether the EU will join an anti-China tech alliance or pursue an independent China policy instead.

Europe: Torn between the US and China

The US tech Cold War with China represents a challenge to European governments, companies, and scholars alike. The two countries are the EU’s most important trade partners. Well-developed S&T ties exist between European countries and China, and many companies in Europe have a strong presence in China and/or rely heavily on the Chinese market. Given their close business involvement in China, European companies worry about the emergence of two separate blocs – consisting of a China-allied trading bloc and supply chain on the one side, and a US-allied one with different trade and technology ecosystems on the other (Hoecker, Li, and Wang 2020: 55).

Despite the absence of geopolitical rivalry or competition over technological leadership, the EU’s view on China has undergone substantial changes since 2016. The EU’s new narrative of China mirrors the country’s transition to a global power on the basis of economic and political norms and values divergent from those of Western counterparts. In March 2019 the communication of the European Commission to the European Council, “EU-China – A Strategic Outlook,” referred to this development as follows: “There is a growing appreciation in Europe that the balance of challenges and opportunities presented by China has shifted.” It was furthermore noted that the EU needs to take a fair, balanced, and mutually beneficial course moving forwards. Although China is still regarded as an important cooperation partner, the EU also now calls the country “an economic competitor in the pursuit of technological leadership, and a systemic rival promoting alternative models of governance” (European Commission 2019).

Given the vital economic role that China plays for the EU, the idea of disengagement or decoupling from the Asian country has so far not received much official support in Europe. At the press conference following the EU-China High Level Strategic Dialogue of June 2020, European Commission (EC) High Representative and EC Vice-President Josep Borrell Fontelles stressed the importance of China – saying the country “is without doubt one of the key global players. This is a fact, and China will increase its global role. We have to engage with China to achieve our global objectives, based on our interests and values” (European External Action Service 2020). Following a similar line of argument, the authors of a study requested by the European Parliament on trade and investment relations between the EU and China conclude that “the EU needs to reassess its longer term strategy of engagement with China. Systemic rivalry is, of course, one option but cannot be the only one. China is too big a partner for the EU, and systemic rivalry as a starting point can easily lead to deteriorating relations and even outright confrontation” (European Parliament 2020: 68).

Referring to US–China global competition over power and status, Lippert and Perthes (2020) warn that rivalry has in general become a dominant paradigm in international relations once again over the past few years, determining not only strategic debates but also real-world political, military, and economic dynamics. The authors observe growing threat perceptions, and recommend that the EU design its own China policy. “Europe needs to escape the bipolar logic that demands it choose between the American and Chinese economic/technological spheres” (Lippert and Perthes 2020: 2).

Following EC President Ursula von der Leyen’s words in her inauguration speech of November 2019, achieving tech sovereignty should be an important goal for the EU. Acknowledging that Europe needs to increase its competitiveness in key related areas, von der Leyen claims that the Union “must have mastery and ownership of key technologies.” This includes regarding quantum computing, AI, blockchain, as well as chip technologies (Kelly 2020).

Due to its dependence on trade with the two countries, taking side in the geopolitical rivalry between the US and China would come at a high cost for the EU – and especially for European companies. Being caught in the middle of US–China competition over technology leadership, what policies measures are available, then, to the EU and European companies? The answer to this takes in different layers and actors. First, possessing one of the world’s largest markets and being one of the most important locations for research and innovation globally, the EU should rely more on its counterbalancing power and pursue a policy of tech sovereignty. Understanding this as a long-term goal to become technologically more independent from the US and China and regain control over key technologies, means that, for example, the so-called Important Projects of Common European Interest should be expanded to new fields. In addition to already-launched projects such as the computing network with specific European standards (Gaia-X), the European Battery Alliance, and the European Raw Materials Alliance, new EU-wide R&D collaboration should be initiated on the above-mentioned future technologies too. Given the significant gap that exists between European member states with regard to R&D capacities and digital development, the leading economies should be the frontrunners in these new projects.

Second, within multilateral organisations (especially the World Trade Organization, WTO), the EU should cooperate with all countries supportive of the necessary reform of the dispute settlement system, the role of state-owned enterprises, industrial subsidies, and digital trade. With regard to personal-data protection policy, the EU should leverage its weight as one of the largest consumer markets worldwide to develop WTO standards that allow strict data protection on the one hand but avoid those standards becoming a digital trade barrier on the other.

Third, the EU has included many countries in its various research programmes on tackling cross-border S&T challenges. Based on this experience, the EU should use its role as a “rule-maker” to influence global S&T governance. Working with the best and striving for excellence requires that research programmes stay open to Chinese scholars as well.

Fourth and finally, European companies have to get prepared for a continuation of the US–China tech decoupling. Although the Biden presidency will adopt a more moderate tone vis-à-vis China, the US’s containment policy will require companies to be present in both the China-allied and the US-allied blocs of trade and innovation.

Footnotes

References

Boustany Jr, Charles W., and Aaron L. Friedberg, (2019), Partial Disengagement – A New U.S Strategy for Economic Competition with China, www.nbr.org/wp-content/uploads/pdfs/publications/sr82_china-task-force-report-final.pdf (1 November 2020).

Brunnstrom, David, and Humeyra Pamuk (2020), China Unlikely to Find Biden a Soft Touch, in: Reuters, 7 November, https://de.reuters.com/article/us-usa-election-china-biden/china-unlikely-to-find-biden-a-soft-touch-idUSKBN27N0XP (20 November 2020).

China State Council (2020), 中共中央关于制定国民经济和社会发展第十四个五年规划和二〇三五年远景目标的建议 [Proposals of the Central Committee of the Communist Party of China on Formulating the Fourteenth Five-Year Plan for National Economic and Social Development and the Long-term Goals for 2035], www.gov.cn/zhengce/2020-11/03/content_5556991.htm (3 December 2020).

Diamond, Larry, and Orville Schell (2018), Chinese Influence & American Interests – Promoting Constructive Vigilance, Stanford California: Hoover Institution Press, www.hoover.org/sites/default/files/research/docs/chineseinfluence_americaninterests_fullreport_web.pdf (1 November 2020).

EducationData.org, International Student Enrollment Statistics, https://educa tiondata.org/international-student-enrollment-statistics#chinese-students-in-the-us (15 November 2020).

EEAS (European Union External Action Service) (2020), EU-China Strategic Dialogue: Remarks by High Representative/Vice-President Josep Borrell at the Press Conference, 9 June, https://eeas.europa.eu/headquarters/headquarters-Homepage/80639/eu-china-strategic-dialogue-remarks-high-representativevice-president-josep-borrell-press_zh-hans (20 November 2020).

European Commission and High Representative (2019), EU-China – A Strategic Outlook, https://ec.europa.eu/commission/sites/beta-political/files/communication-eu-china-astrategic-outlook.pdf (1 November 2020).

European Parliament (2020), EU-China Trade and Investment Relations in Challenging Times, Policy Department for External Relations Directorate General for External Policies of the Union, www.europarl.europa.eu/RegData/etudes/STUD/2020/603492/EXPO_STU(2020)603492_EN.pdf (1 November 2020).

Frietsch, Rainer et al. (2019), Erster Bericht Monitoring des Asiatisch-Pazifischen Forschungsraums (APRA) mit Schwerpunkt China, www.kooperation-international.de/fileadmin/user_upload/apra_performance_2018.pdf (15 November 2020).

Hammer, Alexander B., and Shahid Yusuf (2020), Is China in a High-Tech, Low-Productivity Trap?, Economic Working Paper Series, U.S. International Trade Commission, www.usitc.gov/publications/332/working_papers/2020-07_chinainnovationwphammeryusuf.pdf (15 November 2020).

Hoecker, Anne, Shu Li, and Jue Wang (2020), US and China: The Decoupling Accelerates, Technology Report 2020, Bain & Company, https://www.bain.com/insights/topics/technology-report/ (15 November 2020).

Kroll, Henning et al. (2020), Zweiter Bericht Monitoring des Asiatisch-Pazifischen Forschungsraums (APRA) mit Schwerpunkt China, www.isi.fraunhofer.de/con tent/dam/isi/dokumente/cci/2020/APRA_Monitoring-Bericht-2020.pdf (20 November 2020).

Lippert, Barbara, and Volker Perthes (eds) (2020), Strategic Rivalry between United States and China, Stiftung Wissenschaft und Politik, www.ssoar.info/ssoar/handle/document/68408 (1 November 2020).

Kelly, Èanna (2020), Decoding Europe’s New Fascination with ‘Tech Sovereignty’, in: Science Business, 3 September, https://sciencebusiness.net/news/decoding-europes-new-fascination-tech-sovereignty# (20 November 2020).

Lloyd-Damnjanovic, Anastasya, and Alexander Bowe (2020), Overseas Chinese Students and Scholars in China’s Drive for Innovation, www.uscc.gov/sites/default/files/2020-10/Overseas_Chinese_Students_and_Scholars_in_Chinas_Drive_for_Innovation.pdf (15 November 2020).

Schneider-Petsinger, Marianne, Jue Wang, Yu Jie, and James Crabtree (2019), US-China Strategic Competition: The Quest for Global Technological Leadership, Chathamhouse Research Paper, November

US Census Bureau (adv), Advanced Technology Product Code Descriptions, www.census.gov/foreign-trade/reference/codes/atp/index.html (20 November 2020).

General Editor GIGA Focus

Editor GIGA Focus Asia

Editorial Department GIGA Focus Asia

Regional Institutes

Research Programmes

How to cite this article

Schüller, Margot, and Yun Schüler-Zhou (2020), United States–China Decoupling: Time for European Tech Sovereignty, GIGA Focus Asia, 7, Hamburg: German Institute for Global and Area Studies (GIGA), https://nbn-resolving.org/urn:nbn:de:0168-ssoar-71026-4

Imprint

The GIGA Focus is an Open Access publication and can be read on the Internet and downloaded free of charge at www.giga-hamburg.de/en/publications/giga-focus. According to the conditions of the Creative-Commons license Attribution-No Derivative Works 3.0, this publication may be freely duplicated, circulated, and made accessible to the public. The particular conditions include the correct indication of the initial publication as GIGA Focus and no changes in or abbreviation of texts.

The German Institute for Global and Area Studies (GIGA) – Leibniz-Institut für Globale und Regionale Studien in Hamburg publishes the Focus series on Africa, Asia, Latin America, the Middle East and global issues. The GIGA Focus is edited and published by the GIGA. The views and opinions expressed are solely those of the authors and do not necessarily reflect those of the institute. Authors alone are responsible for the content of their articles. GIGA and the authors cannot be held liable for any errors and omissions, or for any consequences arising from the use of the information provided.