- Home

- Publications

- GIGA Focus

- Digital Platforms in Africa: the „Uberisation“ of Informal Work

GIGA Focus Africa

Digital Platforms in Africa: the „Uberisation“ of Informal Work

Number 7 | 2019 | ISSN: 1862-3603

The “Uberisation” of work – the increasing use of digital platforms by self-employed service providers – is often seen as a pathway into precarious employment in rich countries. In Africa, quite the opposite may be true: the rise of digital platforms offers new opportunities for informal entrepreneurs to become more productive, and eventually formalise.

Digitalisation in Africa is happening on a scale and at a pace that many would not have anticipated. Digital platforms – such as Uber, Airbnb, and local varieties – are spreading. At the same time, most African economies are characterised by the pervasive informality of firms and employment.

Informality is high because formalisation does not pay for firms. Digitalisation is likely to affect both the costs and benefits of formalising. Digital platforms can increase firm and worker productivity, for example through better market access, and they also provide an entry point for formalising firms.

The Uberisation – and formalisation – of employment could be beneficial to the many African self-employed. Anecdotal evidence suggests that self-employed drivers registered on a digital platform, for example, have higher earnings than “conventional” taxi ones. Customers can benefit from better services and lower prices, and governments can raise their capacity to generate tax revenue using information from online platforms and digital transactions.

Overall, the positive effects of digital platforms seem to outweigh the negative ones. At the same time, adjustment costs – as evident in the protests by established taxi drivers witnessed in many countries – need to be addressed and mitigated.

Policy Implications

There is very limited empirical evidence on the effects of digitalisation in general, and of digital platforms in particular, in Africa. Such research is urgently needed to harness the potential of new technologies for inclusive economic development. Digital platforms can contribute to formalising economies and improving tax collection in Africa. Smart policies and regulation need to achieve these ends without inhibiting innovation and technology adoption.

Digitalisation in Africa amid Pervasive Informality

Digitalisation, understood as the transformation of economies and societies induced by digital technologies, is changing people’s lives and behaviour around the world, including in Africa – where this transformation is taking place on a scale and at a pace many would not have anticipated. The share of the population owning a mobile phone has quickly climbed to 45 per cent in sub-Saharan Africa (SSA), and one-quarter uses mobile Internet (GSMA 2019). African countries pioneered mobile payment systems that have boosted financial inclusion across the continent and which are now spreading to other regions of the world. Hundreds of thousands of entrepreneurs use Uber, Airbnb, and similar digital platforms to offer their services, which are used by millions of customers. Finally, there are vibrant tech start-up scenes in some places, most notably in Lagos, Nairobi, and South Africa. This start-up scene has received quite some attention in development policy circles (there are now 618 tech hubs on the African continent; Bayen and Giuliani 2018), but it is digital platforms that could have the most important impacts on people’s livelihoods and SSA’s labour markets.

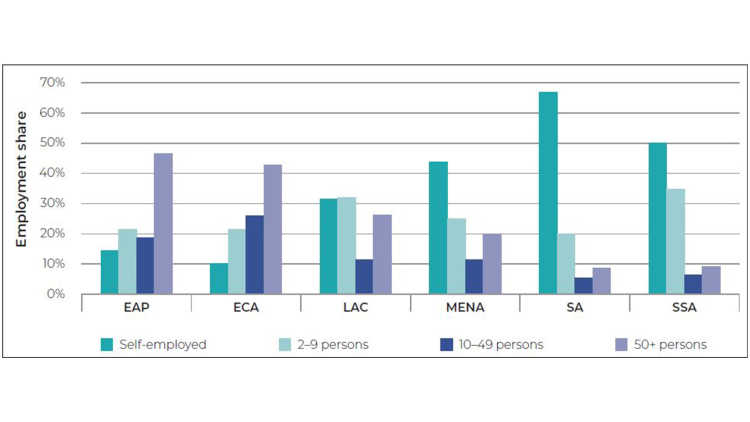

These developments, however, are taking place in an economic environment generally characterised by relatively modest overall economic growth, little structural change, and, in particular, the pervasive informality of firms and employment. A recent report by the International Labour Organisation (ILO) confirmed that employment in SSA is still overwhelmingly small-scale and informal. More than 80 per cent of employment is in enterprises with less than ten employees, and the self-employed working without any employees alone make up 50 per cent of total employment (see Figure 1 below). In a country like Côte d’Ivoire, more than 90 per cent of employment is in the informal sector (ILO 2019). While these findings are hardly surprising, the new, more accurate data basis lends fresh urgency to shining a spotlight on the self-employed and very small businesses – as key factors in generating productive employment at scale in SSA.

The vast majority of the self-employed as well as micro and small firms are informal – that is, not formally registered with the authorities, in particular for tax purposes. Informal employment is mainly understood as being employed without a contract, and can – in principle – be in both formal and informal firms. Informal employees generally have no legal security or protection from exploitation and abuse, inadequate and volatile earnings, as well as no access to healthcare and social security. As informal firms, informal workers do not pay taxes. This implies that the prevalence of non-registered firms and self-employment has major implications for collecting taxes and mobilising domestic public resources.

It is noteworthy that rising incomes, urbanisation, and the associated decline of employment in agriculture has not been associated with a decline in informality in SSA. This is because industrial output and employment have been more or less stagnant, with non-agricultural employment being created almost exclusively in the service sector – where small-scale informal enterprises prevail.

Why African Firms Do Not Formalise despite Lower Business Registration Costs

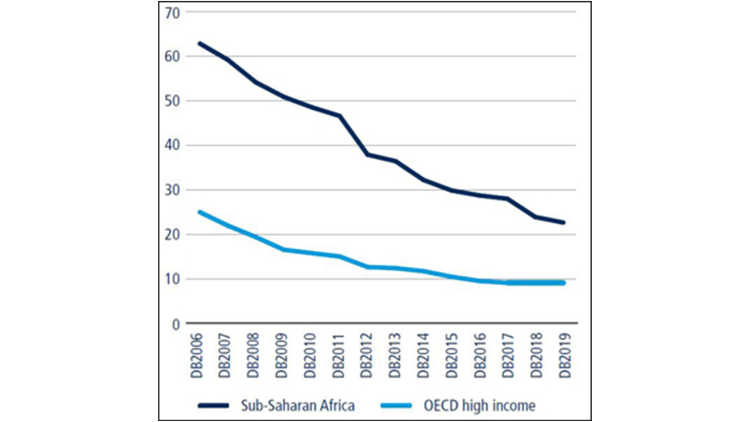

Informality may constrain firm growth and success. Potential formalisation benefits for firms could arise from improved access to credit, greater scope for marketing and engaging with larger firms and the government, a lower risk of being fined, and better access to (government) training and support programmes (Bruhn and McKenzie 2014). For dependent workers, their firm’s formal status may lead to better employment conditions – including a formal contract or even access to social security. Finally, the government may hope for increased tax collection from informal firms. Yet, despite considerable efforts on the part of African governments to simplify registration procedures for firms – as Figure 2 below illustrates, the average number of days to register a business in SSA has halved over the past ten years – the share of unregistered firms remains stubbornly high.

The main reason why these formalisation policies have typically failed to increase the number of registered businesses is that the benefits of formalising are perceived as small by governments and firms alike. For governments, the revenue potential of formalising and taxing small, informal firms is very limited, and may even be outstripped by the high costs of tax collection per firm. Simplified approaches, such as presumptive taxes assuming a certain income rather than relying on income declarations, are somewhat effective in reducing costs for both sides but run the risk of placing a relatively high tax burden on the smallest firms. Empirical evidence on the impacts of different types of formalisation policy on firm registration shows that most interventions – for example reducing the amount of time and money that firms spend on registration, or providing information on how to register – are not sufficient to motivate firms to register (Bruhn and McKenzie 2014; Jessen and Kluve 2019). For informal firms, the perceived benefits of formalisation – such as access to government services, or improved access to credit – are often uncertain, and insufficient to compensate for registration costs, subsequent tax payments, or even harassment by public authorities.

Digital Platforms Can Make Formalisation Worthwhile

Given that firms’ formalisation decisions and governments’ formalisation efforts largely come down to a cost–benefit assessment, digitalisation has the potential to boost formalisation rates among the self-employed and small firms by cutting costs and enhancing benefits. As digitalising tax administration can make collecting revenues much cheaper, it may become worthwhile for governments to target smaller firms – where monitoring costs previously exceeded expected tax revenues. Digital platforms connecting small-scale entrepreneurs to an online market can serve as the entry point for governments to get firms registered.

At the same time, firms’ perceived benefits from formalisation may rise substantially if getting registered comes as a package deal with improved (online) market access, thus motivating even small firms to seek tax registration. Digital platforms can potentially play an important role in many key activities of the informal sector, such as retail, transport, or domestic services. In these activities, digital platforms may not only offer the benefit of a larger customer base but possibly also improved contract enforcement (e.g. through customer ratings and smooth payments) – thus addressing a key challenge for small businesses. On top of that, the digital recording of business transactions would not only mean better accounting practices but also imply that income declarations for tax purposes could easily be produced. More precise income estimates can result in less unintended regressive taxation for the smallest firms.

A similar argument can be made for the formalisation of labour and access to social security. While tax-financed, non-contributory social transfer programmes have recently become more common throughout the developing world, such schemes are still the exception in SSA and typically target particularly vulnerable groups (Dodlova, Giolbas, and Lay 2018). In many African countries, government-run, contributory social security programmes cater to a minority of formal employees. The self-employed and smaller businesses could, in principle, participate voluntarily in these programmes, but mostly lack the financial stability to do so. Digitalisation could change the rationale to sign up for contributory social security, but only if earnings increased, contributions were reduced, and procedures to enrol and make claims were simplified.

“Uberisation” as a Stepping Stone in Highly Informal Economies

In principle the business model of digital platforms, which typically relies on small, self-employed service providers, fits well with a large number of such enterprises. This explains the select successes of app-based online platforms especially in the service sector. In the transport one, digital platforms connecting self-employed drivers to customers have rapidly gained ground. Uber is now active in eight African countries, 24 cities, and has more than 60,000 active drivers according to company information; its rival Bolt (formerly Taxify) is active in 44 cities and six countries of the continent. There are various similar start-ups catering to local markets, such as the motorcycle taxi app SafeBoda in Kenya and Uganda. E-commerce platforms are spreading across the continent. Jumia, also dubbed the “African Amazon,” now connects buyers and sellers in 14 African countries, and has 500,000 merchants registered on its platform. In Kenya, one of the most advanced African countries in terms of digital innovation, there are now online platforms for services as diverse as artisanal work, homecare and cleaning services, and micro-task work in the information technology sector.

Despite the widespread criticism of “Uberisation” in the transport sector, meaning the reliance of ride-hailing platforms on self-employed drivers who lack work contracts and social security, such an individual registered on a digital platform (henceforth, “platform driver”) may be better off than his or her taxi driver counterpart. This is because the platform driver has more potential customers and spends less time waiting or searching for them, thus also saving fuel. Prices are set and adhered to; contractual risks are reduced. Further, customer and driver rating systems reduce potential conflicts over routes and fares. With regard to job and legal security, as well as access to social protection, the platform driver and the taxi driver are likely to be roughly on a par in most SSA cities. Unfortunately, there is thus far no systematic empirical evidence regarding earning differences between the two groups. Anecdotal evidence from Accra suggests that Uber drivers can earn three times as much as taxi ones.

However such anecdotal evidence may be misleading, as looking at high weekly earnings obscures the fact that it often takes 16-hour days to realise such lofty incomes. Also, platform drivers are at the mercy of their companies’ price-setting decisions, and superior earnings may not necessarily remain so in the medium term. Ever-expanding numbers of platform drivers as well as fierce competition with both established taxi operators and other ride-hailing platforms have driven the earnings of Uber drivers down in previous years. A case study of the Nairobi market by the Center for Global Development shows that Uber’s kilometre fare halved between 2015 and 2018, prompting two (relatively unsuccessful) waves of protest by the company’s drivers in 2017 (Zollman and Ng’weno 2018). Still, being a platform driver compares favourably to many other jobs in the earnings dimension, as such individuals can earn as much as the monthly wage of a medium-skilled worker in a single week if using their own car.[2] Being a platform driver is also not significantly worse than most other jobs in the non-earnings dimension, as the overwhelming majority of jobs in SSA – at least in current circumstances – do not offer formal social security. In terms of informal insurance, the picture is not yet clear. Taxi drivers who belong to taxi stations in Accra, for instance, are often organised into groups that may also serve as informal savings and insurance networks; platform drivers are on their own, meanwhile. At the same time, platform drivers may still have access to other informal networks and have any shortfalls be partly compensated for by higher incomes.

While there is ongoing discussion around the effects of digital platforms on financial inclusion, a thorough assessment of the overall welfare effects of ride-hailing platforms remains to be done; it would have to look beyond the effects on driver earnings, and working conditions. It is very obvious that the presence of Uber and others has exerted acute competitive pressure on established taxi companies and drivers (as well as on operators of other transport modes too). Violent protests against “unfair competition” by incumbent taxi operators in Nairobi and Johannesburg bear witness to this. However, these protests may not necessarily be in the best interests of the population at large. Customers benefit from lower fare prices and will mostly appreciate knowing the identity of the driver, for example for security reasons.

An important question in an assessment of the welfare impacts of ride-hailing platforms would be where exactly they recruit their drivers from: are old jobs transformed or destroyed, are new ones created? Again, systematic knowledge is lacking. Anecdotal evidence suggests, however, that drivers come partly from the informal sector, partly from among the unemployed, but also partly from the realm of the formally employed. New entrants thus threaten the jobs of established drivers, as new technologies disrupt the transport sector. The importance of knowing Accra’s roads and landmarks by heart wanes considerably, while the abilities to operate the app, read a map, and navigate accordingly become vital skills. While public opinion may often tend to side with the incumbent, in this case the established taxi driver, it is not immediately clear that he or she should be protected against the entry of a formerly unemployed person. At the same time, upholding a level playing field means that regulations need to apply to platform drivers and taxi drivers alike – which is often not the case. Another important question is whether being a platform driver can be a stepping stone towards other, even more productive activities, or even a fully formalised business. Success stories of platform drivers who managed to grow their fleet to multiple cars in a matter of years suggest that this potential exists, but it is too early to assess the effects in the medium to long term.

Overall, it seems that the positive effects experienced by many are likely to outweigh the negative ones for the few. The adverse consequences will, in fact, be concentrated on a single group of people: established taxi drivers with difficulties to use and adjust to the new technologies. Similar challenges may arise in other sectors such as the retail and hospitality ones, albeit losses are likely to be less concentrated. Yet, we should emphasise once again that a comprehensive and solid empirical analysis that would allow for definite conclusions on the socio-economic implications of the rise of digital platforms in Africa remains to be conducted.

Digitalisation and Taxation

Digital platforms are not only impacting on service providers and customers, however. They also matter for governments and tax collection. To stick with the Uber example, the established taxi driver generates government revenue by paying for a taxi licence. Instead the platform driver – at least under most current regulations, or in practice – does not have such a licence, but rather pays fees to the platform operator – often a foreign company. This is clearly not an ideal situation from a regulatory and tax revenue perspective. Governments and regulations in rich and poor countries alike need to adapt to new technologies and harness their opportunities. These exist for tax registration and collection too.

Regarding digital platforms, the main challenge for governments often is to get their operators to cooperate – for example by requiring government registration when signing up to a platform, or by making sharing data compulsory to support tax collection. The Kenyan authorities, for example, have repeatedly clarified that drivers on ride-hailing platforms are liable to pay income tax and VAT, and are currently wrestling with Uber to get the company to disclose information on its drivers in order to enforce this requirement. Uber, meanwhile, is citing data protection reasons for not sharing information on the drivers on its platform, and generally does not accept any liability for their tax compliance. As the platform business model relies on low levels of regulation and government levies, foreign companies have very little incentive to cooperate voluntarily – while African governments have little leverage to force them to.

Beyond platforms, digitalisation offers a number of other opportunities to widen the tax base, improve compliance, and decrease the costs of tax collection in highly informal economies. Kenya, with its burgeoning information and communications technology sector and mobile money transactions there being equivalent to almost half of the country’s gross domestic product, has emerged as an African pioneer in the field of digital taxation. Its iTax system, introduced in 2013, allows users to pay all taxes and manage their accounts online. It was complemented in 2014 by the KRA-M system, which allows for tax payments via mobile money. Both systems have simplified tax registration and payments for citizens, while also delivering significant reductions in the cost of tax collection for the authorities too (Ndung’u 2017).

Further, governments have started to target digital transactions through financial institutions, who are covered by financial sector regulation and hence obligated to cooperate. Kenya and Uganda recently introduced taxes on mobile money transactions; Nigeria, meanwhile, has announced VAT will soon be charged on card payments for goods and services made through digital platforms. The drawbacks: both approaches create disincentives for digital payment, thus threatening the gains made in terms of financial inclusion (Ndung’u 2019); targeting consumption and transactions implies a higher relative tax burden for the poor as well.

Policy Dilemmas: Harnessing the Potential of Digitalisation for Development without Compromising Innovation

Governments in Africa (and elsewhere) have a delicate task ahead of them. They want to harness the efficiency gains and tap the revenue potential that digital platforms and the increasing number of digital transactions occurring offer. They also, simultaneously, do not want to choke off technological progress and innovation, in particular as adapted to local conditions. At the same time, they do not want to permit technology firms to exploit the deficiencies in their regulatory environments or to undercut labour standards and social security necessities. This is a genuine risk, since a significant number of the business models utilised by digital platforms work best in unregulated markets. African governments will thus be faced with sensitive policy decisions. How, for example, to deal with a foreign company that refuses to cooperate in terms of enforcing regulation or sharing sales and earnings data so as to support tax collection?

In principle, digital platforms can contribute to formalising economies and improving tax collection in Africa. The empirical evidence on formalisation efforts there and elsewhere very clearly shows that firms need to perceive the benefits of formalising. These gains can be enhanced when formalisation is linked to access to related digital platforms and to digital transactions, which might induce more self-employed entrepreneurs and small-scale firms to seek registration in the first place. However, great care should be taken in order not to dis-incentivise the use of these technologies – for example by taxing digital payments too heavily. There is good reason to believe that the earnings of entrepreneurs can be improved through their participation in digital platforms; more evidence is certainly needed on the welfare impacts of such platforms however, including especially the effects thereof on the incumbents.

The authors would like to thank the Federal Ministry for Economic Cooperation and Development (BMZ) for funding the research project “RéUsSITE – Research Support to the Special Initiative on Training and Job Creation.” We also thank Lavri Labi for helpful discussions and background information on African IT start-up landscapes, Sidney Ng’ethe for sharing his knowledge of the Kenyan platform economy, and Felix Danso for important insights into Accra’s transport sector.

Footnotes

References

Bayen, Maxime, and Dario Giuliani (2018), Tech Hubs Ecosystems across Africa and Asia, https://briterbridges.com/618-active-tech-hubs (9 November 2019).

Bruhn, Miriam, and David McKenzie (2014), Entry Regulation and the Formalization of Microenterprises in Developing Countries, in: The World Bank Research Observer, 29, 2, 186–201, https://doi.org/10.1093/wbro/lku002.

de Vries, Gaaitzen, Marcel Timmer, and Klaas de Vries (2015), Structural Transformation in Africa: Static Gains, Dynamic Losses, in: The Journal of Development Studies, 51, 6, 674–688, https://doi.org/10.1080/00220388.2014.997222.

Dodlova, Marina, Anna Giolbas, and Jann Lay (2018), Non-Contributory Social Transfer Programs in Developing Countries: A New Dataset and Research Agenda, in: Data in Brief, 16, 51–64, https://doi.org/10.1016/j.dib.2017.10.066.

GSMA (2019), Mobile Internet Connectivity—Sub-Saharan Africa Factsheet 2018, www.gsma.com/mobilefordevelopment/wp-content/uploads/2019/07/MobileInternet-Connectivity-SSA-Factsheet.pdf (9 November 2019).

ILO (International Labour Organisation) (2019), Small Matters: Global Evidence on the Contribution to Employment by the Self-Employed, Micro-Enterprises and SMEs, Geneva: ILO.

Jessen, Jonas, and Jochen Kluve (2019), The Effectiveness of Interventions to Reduce Informality in Low- and Middle Income Countries, IZA Discussion Paper No 12487.

Morttey, Shepherd Yaw (2018), How to make Money (GHS 1,500 or more) Weekly in Ghana Using Uber, 3 March, https://mfidie.com/make-money-ghana-uber/ (19 November 2019).

Ndung’u, Njuguna (2019), Taxing Mobile Phone Transactions in Africa: Lessons from Kenya, Brookings Institution, Africa Growth Initiative Policy Brief.

Ndung’u, Njuguna (2017), Digitalization in Kenya: Revolutionizing Tax Design, in: Sanjeev Gupta, Michael Keen, Aopa Shah, and Genevieve Verdier (eds), Digital Revolutions in Public Finance, Washington, DC: International Monetary Fund.

World Bank (2019), Doing Business 2019, Training for Reform, Washington, DC: World Bank.

Zollman, Julie, and Amolo Ng’weno (2018), Uber and Taxify in Africa: Good Work or a Race to the Bottom?, Center For Global Development, 11 June, www.cgdev.org/blog/uber-and-taxify-africa-good-work-or-race-bottom (23 October 2019).

General Editor GIGA Focus

Editor GIGA Focus Africa

Editorial Department GIGA Focus Africa

Regional Institutes

Research Programmes

How to cite this article

Lakemann, Tabea, and Jann Lay (2019), Digital Platforms in Africa: the „Uberisation“ of Informal Work, GIGA Focus Africa, 7, Hamburg: German Institute for Global and Area Studies (GIGA), https://nbn-resolving.org/urn:nbn:de:0168-ssoar-65910-4

Imprint

The GIGA Focus is an Open Access publication and can be read on the Internet and downloaded free of charge at www.giga-hamburg.de/en/publications/giga-focus. According to the conditions of the Creative-Commons license Attribution-No Derivative Works 3.0, this publication may be freely duplicated, circulated, and made accessible to the public. The particular conditions include the correct indication of the initial publication as GIGA Focus and no changes in or abbreviation of texts.

The German Institute for Global and Area Studies (GIGA) – Leibniz-Institut für Globale und Regionale Studien in Hamburg publishes the Focus series on Africa, Asia, Latin America, the Middle East and global issues. The GIGA Focus is edited and published by the GIGA. The views and opinions expressed are solely those of the authors and do not necessarily reflect those of the institute. Authors alone are responsible for the content of their articles. GIGA and the authors cannot be held liable for any errors and omissions, or for any consequences arising from the use of the information provided.